-

Adds Shawn Ryan as Technical Advisor

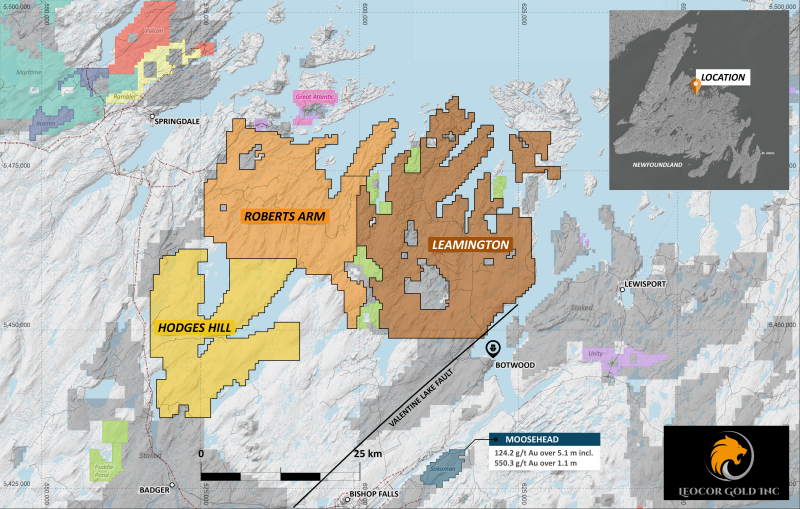

Vancouver, British Columbia - TheNewswire - April 8, 2021 - Leocor Gold Inc. (the “Company” or “Leocor”) (CNSX:LECR.CN) (OTC:LECRF) is pleased to announce that it has entered into three option agreements (the “Hodge’s Hill Agreement”, the “Leamington Agreement”, the “Robert’s Arm Agreement” and collectively, the “Option Agreements”), each dated March 23, 2021 with Shawn Ryan and Wildwood Exploration Inc. (together, the “Optionor”), pursuant to which Leocor has the options (the “Options”) to acquire a 100% interest in 5760 mineral claims, covered by 37 licenses, over 144,000 hectares, in Newfoundland and Labrador.

The three projects acquired - Hodge’s Hill, Leamington, and Robert’s Arm - represent 1,440 square kilometers of prospective exploration ground covering numerous regional geologically favorable corridors conducive to gold mineralization. The Company also wishes to announce that the project vendor, Shawn Ryan, will be joining Leocor as a Technical Advisor, specifically to plan and oversee exploration efforts on the newly acquired ground.

Project Details

Hodge’s Hill – 39,050 hectares

Hodge’s contains major regional NE and NNW structure outlined by the regional NFLD airborne magnetics. This package presents a unique opportunity to evaluate the Hodges Hill gabbro. Gabbro’s have long been recognized as being directly associated with gold mineralization in the Baie Verte area such as Anaconda Mines Pine Cove deposit and more recently the discovery (2014) by Anaconda Mining of the Stog’er Tight and Argyle showings. Recent research conducted by the Geological Survey of Canada (Open File 8658) specifically indicates how the brittle nature of the gabbro-tonalite-granodiorite body (Crippleback intrusive suite) that underlies the Wildling Lake showing and Marathon’s Valentine Lake Gold Project (3.9 Moz*), and which Hodge’s Hill is associated with, makes a highly prospective target for gold deposition.

Leamington – 62,300 hectares

Leamington targets an area measuring 30 km EW by 36 Km NS that hosts the prospective rocks of the Exploits Terrane, which the Newfoundland Government regional till survey showed was anomalous in gold and arsenic. The target also has close to 100 km of various regional structures running through it, with approximately 50-60 sq-km of prospective gabbros.

The claim block’s northern boundary straddles 20 km of the Red Indian Line (“RIL”) suture zone, which is the main deep structural contact between the Laurentia and Gander Terrane boundaries. The project is also flanked along the eastern side (30 km) by the Northern Arm Fault , which is the same fault system that the Valentine Lake project straddles.

Robert’s Arm – 42,650 hectares

Robert’s Arm covers mainly mafic to siliciclastic marine volcanic rocks of late Cambrian to Middle Ordovician age, known as the Wild Bight Group. Running through the Wild Bight unit is a distinct magnetic high gabbro sill unit known as the Gummy Brook Gabbro. It is this unit that is related to the known gold mineralization in the area. The main highlight is that the property is straddling 38 Km of the RIL suture zone and that it also has numerous linear magnetic high anomalies interpreted to be untested gabbro units.

Image 1: Projects acquired, Newfoundland, Canada

“These projects represent a district-scale exploration opportunity for Leocor,” said Alex Klenman, CEO. “This project ground has had limited exploration to date, and we feel the geology, location, historical and recent results all indicate this is a highly prospective, prime target for an aggressive, large scale gold exploration program. We are also pleased to have Shawn join the team as an advisor. He will be instrumental in planning and executing the progressive exploration programs to come,” continued Mr. Klenman.

Shawn Ryan began his career in exploration in the early 80’s working with the Kidd Creek Exploration geophysics team and various other local contracting firms. In 1996, while living in Dawson City, Yukon, he decided to try his luck as a prospector. He focused his prospecting in the Dawson District looking for the sources of alluvial gold. His research led to perfecting a deeper soil sampling technique that became a Yukon industry standard. Shawn received the Spud Huestis Award for excellence in prospecting and mineral exploration from AME BC in 2010 for the White Gold Discovery. In 2011, Shawn was also honored with the Bill Dennis, Prospector of the Year Award by the PDAC for his prospecting success that led to the discovery on the White Gold Property and the Coffee Projects, now owned by Newmont.

“I am pleased to work with Leocor and their management team. The three options were staked to cover key structures, prospective geology and anomalous gold in till,” said Shawn Ryan, Technical Advisor. “Newfoundland is getting ready to go through one the most aggressive gold exploration phases since the 1988-89 rush where more than 80% of the known gold showings were discovered. Since then, our understanding of gold systems has increased dramatically and the Newfoundland Geological Survey has done an exemplary job with their work by providing modern up-to-date geology maps, new till surveys, new airborne surveys, and new regional structural interpretation. With the compilation and interpretation of new data, Leocor will be the first company to directly target some of these key structures. I look forward to planning this summer exploration program with the Leocor team,” continued Mr. Ryan.

Option Terms

In order to exercise the option granted under the Hodge’s Hill Agreement, Leocor must make cash payments to the Optionor of $502,000 and issue 3,000,000 common shares of the Company (“Common Shares”) over five years. Initial payments upon exchange approval of the agreement are $102,000 cash and 500,000 common shares. Leocor must also incur expenditures of at least $2,725,000 by November 15, 2025.

In order to exercise the option granted under the Leamington Agreement, Leocor must make cash payments to the Optionor of $562,000 and issue 4,000,000 Common Shares over five years. Initial payments upon exchange approval of the agreement are $162,000 cash and 1,000,000 common shares. Leocor must also incur expenditures of at least $3,625,000 by November 15, 2025.

In order to exercise the option granted under the Robert’s Arm Agreement, Leocor must make cash payments to the Optionor of $511,000 and issue 4,000,000 Common Shares over five years. Initial payments upon exchange approval of the agreement are $111,000 cash and 1,000,000 common shares. Leocor must also incur expenditures of at least $3,000,000 by November 15, 2025.

Upon exercise of each Option in accordance with the applicable Option Agreement, the Optionor will retain a 2.5% net smelter return (“NSR”) royalty, provided that Leocor will have the right to purchase from the Optionor that portion of the NSR royalty equal to 1.0% of such NSR royalty upon payment of the sum of $2,500,000 to the Optionor at any time.

* Valentine Lake Gold Project, Pre-Feasibility Study, Marathon Gold, April 2020

About Leocor Gold Inc.

Leocor Gold Inc. is a British Columbia-based resource company involved in the acquisition and exploration of precious metal projects, with a current focus in Atlantic Canada. Leocor is a reporting issuer in British Columbia, Alberta and Ontario. Leocor, through outright ownership and earn-in agreements, currently controls over 1600-hectares of prime exploration ground in the prolific Baie Verte Mining District, proximal to known deposits and currently producing mines, including Anaconda Mining’s Pine Cove Mine and Stogertite deposit, and Rambler Metals’ Ming Mine.

Contact Information

Leocor Gold Inc.

Alex Klenman, Chief Executive Officer

Email: aklenman@leocorgold.com

Telephone: (604) 970-4330

Neither the Canadian Securities Exchange nor its Regulation Services Provider (as that term is defined in the policies of the Canadian Securities Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statements Regarding Forward-Looking Information

This press release contains forward-looking information within the meaning of Canadian securities laws. Such information includes, without limitation, information regarding the terms and conditions of the Option. Although Leocor believes that such information is reasonable, it can give no assurance that such expectations will prove to be correct.

Forward looking information is typically identified by words such as: “believe”, “expect”, “anticipate”, “intend”, “estimate”, “postulate” and similar expressions, or are those, which, by their nature, refer to future events. Leocor cautions investors that any forward-looking information provided by Leocor is not a guarantee of future results or performance, and that actual results may differ materially from those in forward looking information as a result of various factors, including, but not limited to: the agreement of the parties to proceed with the proposed transaction on the terms set out in the Option Agreements or at all; Leocor's ability to exercise the Options; the state of the financial markets for Leocor's securities; the state of the natural resources sector in the event the Option, or any of them, are completed; recent market volatility; circumstances related to COVID-19; Leocor's ability to raise the necessary capital or to be fully able to implement its business strategies; and other risks and factors that Leocor is unaware of at this time. The reader is referred to Leocor's initial public offering prospectus for a more complete discussion of applicable risk factors and their potential effects, copies of which may be accessed through Leocor’s issuer page on SEDAR at www.sedar.com.

The forward-looking statements contained in this press release are made as of the date of this press release. Leocor disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

Copyright (c) 2021 TheNewswire - All rights reserved.