Alternative asset manager Ares Management (NYSE: ARES) fell short of the markets revenue expectations in Q4 CY2025, but sales rose 22% year on year to $1.5 billion. Its non-GAAP profit of $1.45 per share was 14% below analysts’ consensus estimates.

Is now the time to buy Ares? Find out by accessing our full research report, it’s free.

Ares (ARES) Q4 CY2025 Highlights:

- Assets Under Management: $622.5 billion vs analyst estimates of $618.2 billion (28.5% year-on-year growth, 0.7% beat)

- Management Fees: $991.1 million vs analyst estimates of $995 million (27% year-on-year growth, in line)

- Revenue: $1.5 billion vs analyst estimates of $1.64 billion (22% year-on-year growth, 8% miss)

- Fee-Related Earnings: $527.7 million vs analyst estimates of $515.7 million (2.3% beat)

- Adjusted EPS: $1.45 vs analyst expectations of $1.69 (14% miss)

- Market Capitalization: $30.24 billion

Company Overview

With roots in the leveraged finance group of Apollo Management, Ares Management (NYSE: ARES) is an alternative investment firm that manages private equity, credit, real estate, and infrastructure assets for institutional and high-net-worth clients.

Revenue Growth

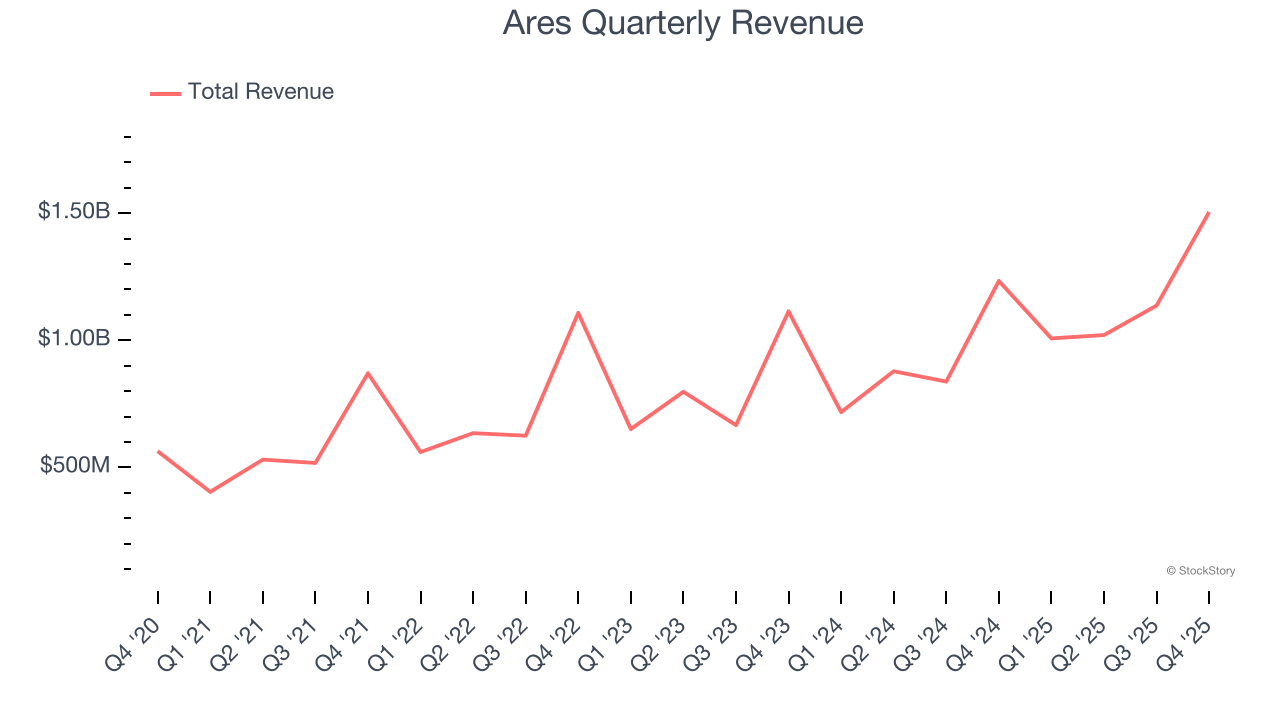

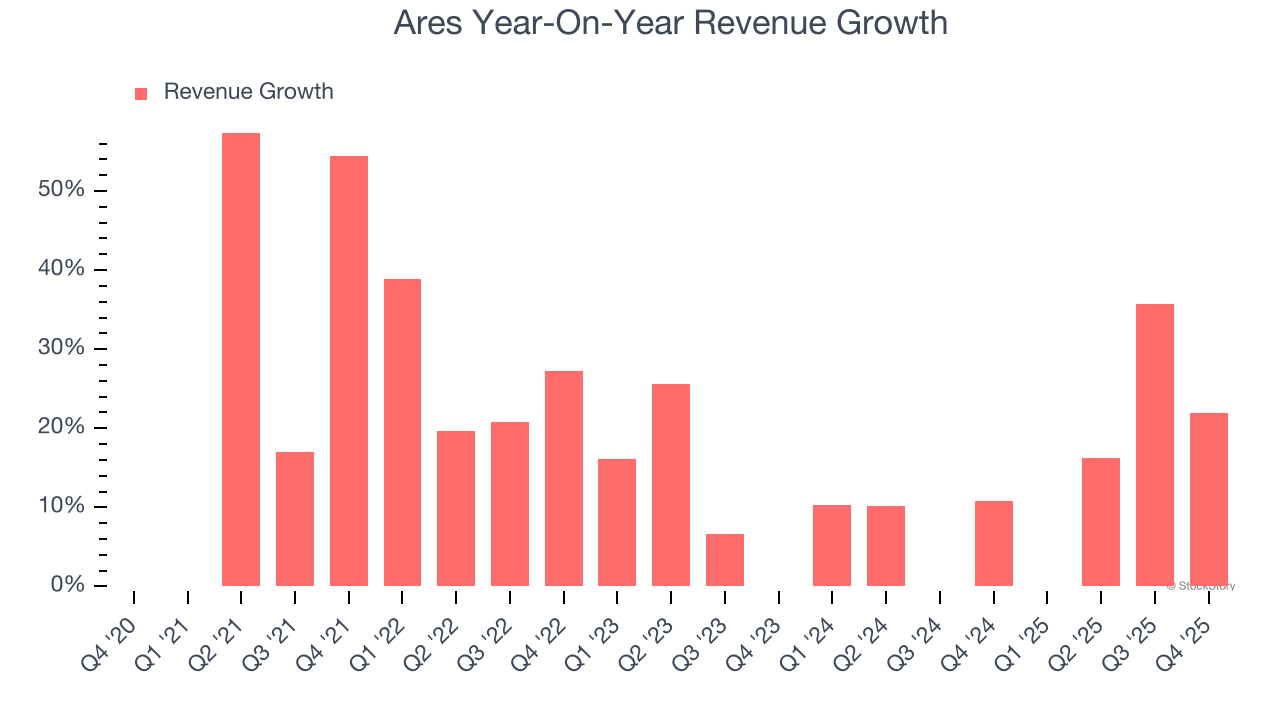

A company’s long-term sales performance is one signal of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Over the last five years, Ares grew its revenue at an excellent 21.3% compounded annual growth rate. Its growth surpassed the average financials company and shows its offerings resonate with customers, a great starting point for our analysis.

Long-term growth is the most important, but within financials, a half-decade historical view may miss recent interest rate changes and market returns. Ares’s annualized revenue growth of 20.3% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, Ares generated an excellent 22% year-on-year revenue growth rate, but its $1.5 billion of revenue fell short of Wall Street’s high expectations.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Key Takeaways from Ares’s Q4 Results

It was encouraging to see Ares beat analysts’ fee-related earnings expectations this quarter. We were also happy its AUM narrowly outperformed Wall Street’s estimates. On the other hand, its revenue missed and its EPS fell short of Wall Street’s estimates. Overall, this quarter could have been better. The stock traded down 2.9% to $133.25 immediately following the results.

The latest quarter from Ares’s wasn’t that good. One earnings report doesn’t define a company’s quality, though, so let’s explore whether the stock is a buy at the current price. If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here (it’s free).