MetLife has been treading water for the past six months, recording a small return of 0.6% while holding steady at $76.77. The stock also fell short of the S&P 500’s 10% gain during that period.

Is there a buying opportunity in MetLife, or does it present a risk to your portfolio? Get the full stock story straight from our expert analysts, it’s free.

Why Do We Think MetLife Will Underperform?

We're cautious about MetLife. Here are three reasons you should be careful with MET and a stock we'd rather own.

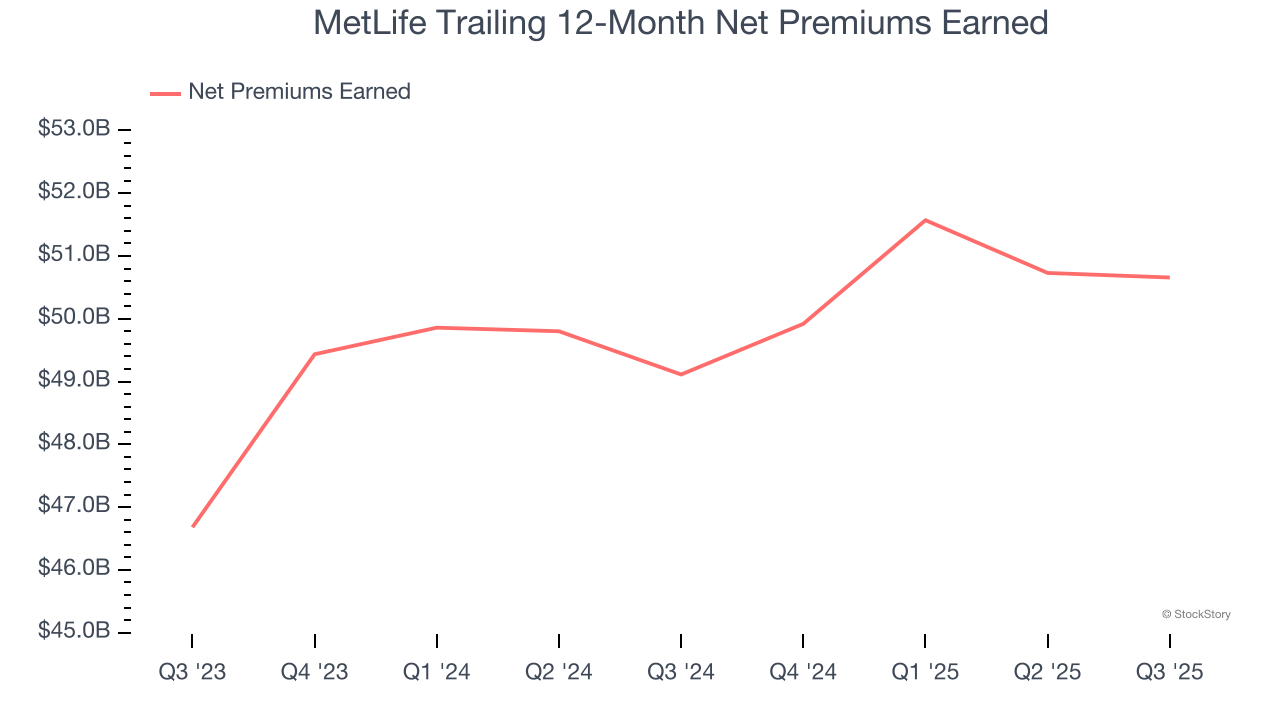

1. Net Premiums Earned Point to Soft Demand

Insurers sell policies then use reinsurance (insurance for insurance companies) to protect themselves from large losses. Net premiums earned are therefore what's collected from selling policies less what’s paid to reinsurers as a risk mitigation tool.

MetLife’s net premiums earned has grown at a 2.1% annualized rate over the last five years, much worse than the broader insurance industry and in line with its total revenue.

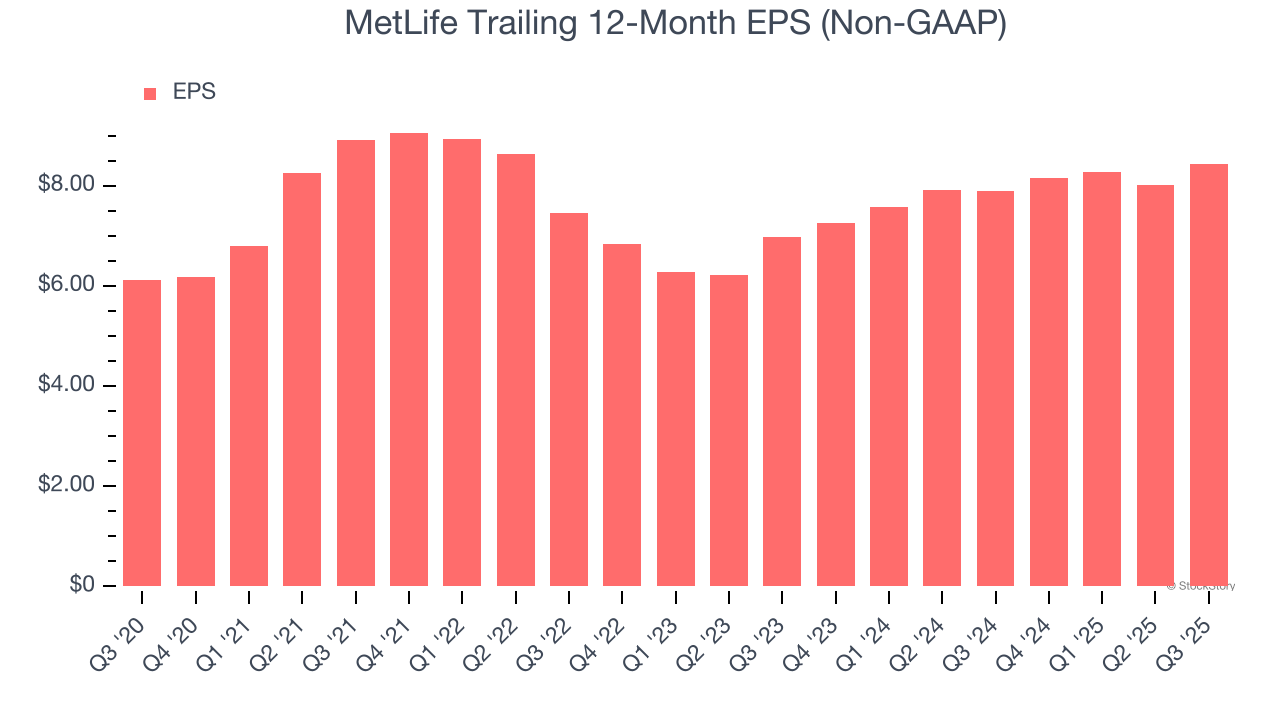

2. EPS Barely Growing

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

MetLife’s EPS grew at an unimpressive 6.6% compounded annual growth rate over the last five years. On the bright side, this performance was better than its 3% annualized revenue growth and tells us the company became more profitable on a per-share basis as it expanded.

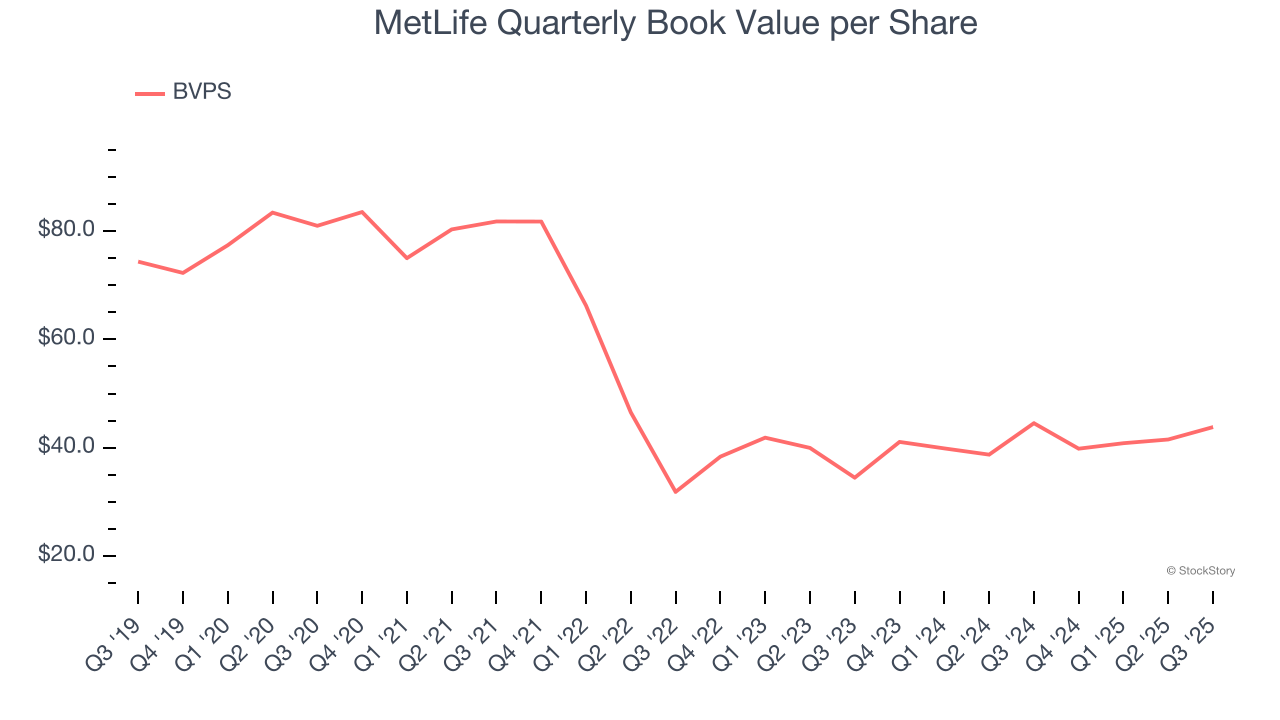

3. BVPS Growth Demonstrates Strong Asset Foundation

Book value per share (BVPS) serves as a key indicator of an insurer’s financial stability, reflecting a company’s ability to maintain adequate capital levels and meet its long-term obligations to policyholders.

Although MetLife’s BVPS declined at a 11.6% annual clip over the last five years. the good news is that its growth inflected positive over the past two years as BVPS grew at a decent 12.7% annual clip (from $34.47 to $43.81 per share).

Final Judgment

We see the value of companies helping consumers, but in the case of MetLife, we’re out. With its shares underperforming the market lately, the stock trades at 1.9× forward P/B (or $76.77 per share). This valuation tells us it’s a bit of a market darling with a lot of good news priced in - we think there are better opportunities elsewhere. Let us point you toward a top digital advertising platform riding the creator economy.

Stocks We Would Buy Instead of MetLife

If your portfolio success hinges on just 4 stocks, your wealth is built on fragile ground. You have a small window to secure high-quality assets before the market widens and these prices disappear.

Don’t wait for the next volatility shock. Check out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.