Healthcare tech company Premier (NASDAQ: PINC) reported Q2 CY2025 results exceeding the market’s revenue expectations, but sales fell by 25% year on year to $262.9 million. On the other hand, the company’s full-year revenue guidance of $970 million at the midpoint came in 0.5% below analysts’ estimates. Its non-GAAP profit of $0.46 per share was 35.1% above analysts’ consensus estimates.

Is now the time to buy Premier? Find out by accessing our full research report, it’s free.

Premier (PINC) Q2 CY2025 Highlights:

- Revenue: $262.9 million vs analyst estimates of $250.4 million (25% year-on-year decline, 5% beat)

- Adjusted EPS: $0.46 vs analyst estimates of $0.34 (35.1% beat)

- Adjusted EBITDA: $71.11 million vs analyst estimates of $63.97 million (27.1% margin, 11.2% beat)

- Adjusted EPS guidance for the upcoming financial year 2026 is $1.38 at the midpoint, missing analyst estimates by 1.1%

- EBITDA guidance for the upcoming financial year 2026 is $237.5 million at the midpoint, above analyst estimates of $234.6 million

- Operating Margin: 9.5%, down from 23.4% in the same quarter last year

- Free Cash Flow Margin: 27.4%, similar to the same quarter last year

- Market Capitalization: $2.01 billion

"I'm pleased to report that we had a strong finish to the year despite the contract renewal headwinds, which are now mostly behind us. Our overall revenue and profitability for the year exceeded our expectations largely due to better-than-anticipated results in our Supply Chain Services segment," said Michael J. Alkire, Premier's President and CEO.

Company Overview

Operating one of the largest healthcare group purchasing organizations in the United States with over 4,350 hospital members, Premier (NASDAQ: PINC) is a technology-driven healthcare improvement company that helps hospitals, health systems, and other providers reduce costs and improve clinical outcomes.

Revenue Growth

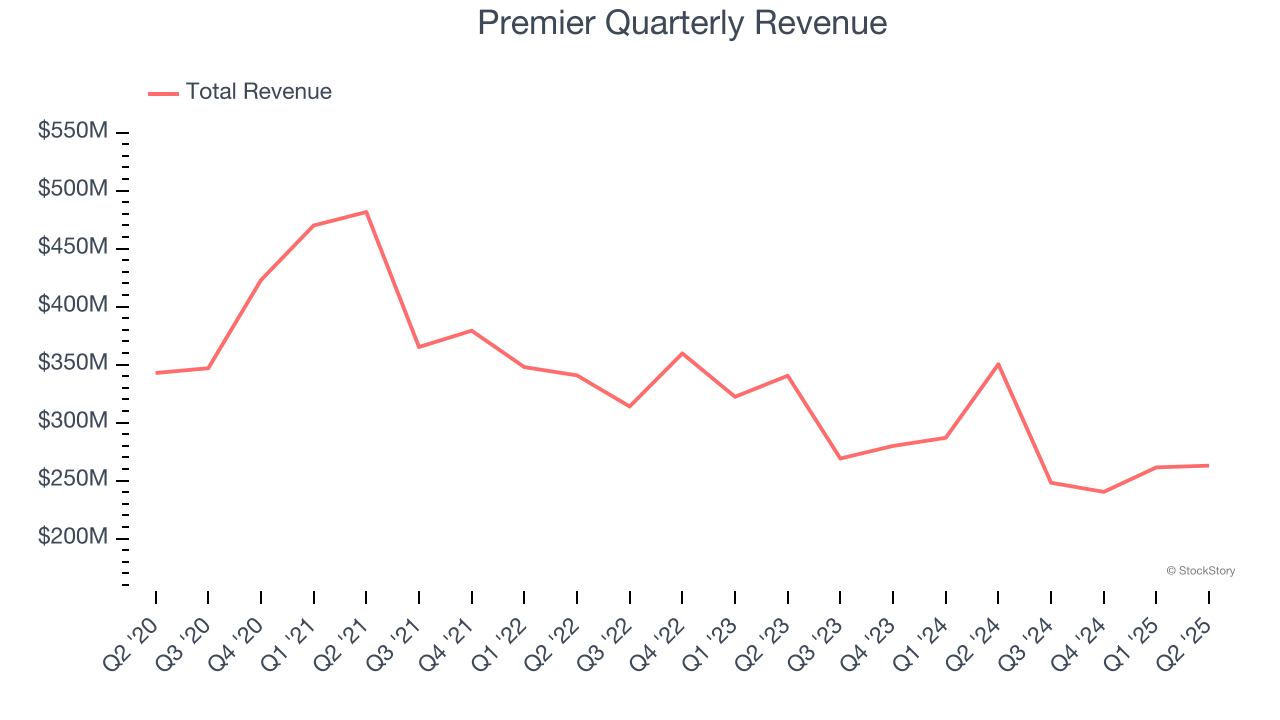

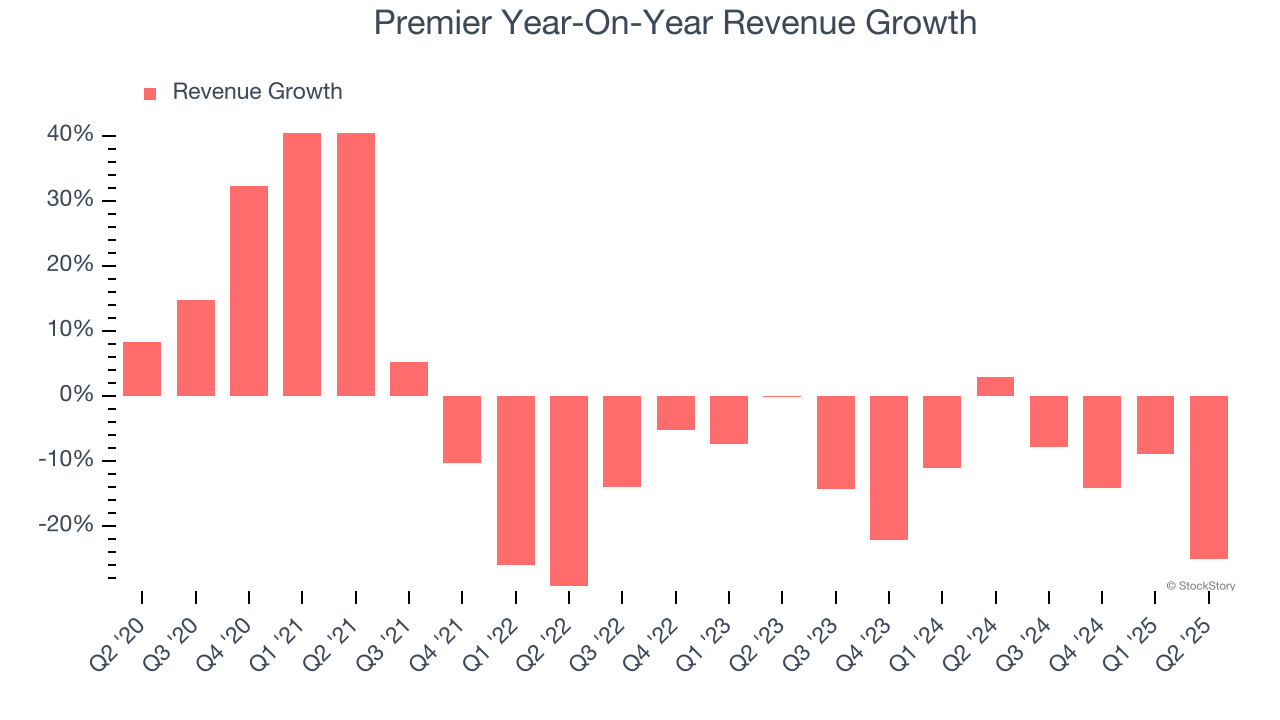

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Premier struggled to consistently generate demand over the last five years as its sales dropped at a 4.9% annual rate. This wasn’t a great result and is a sign of poor business quality.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. Premier’s recent performance shows its demand remained suppressed as its revenue has declined by 12.9% annually over the last two years.

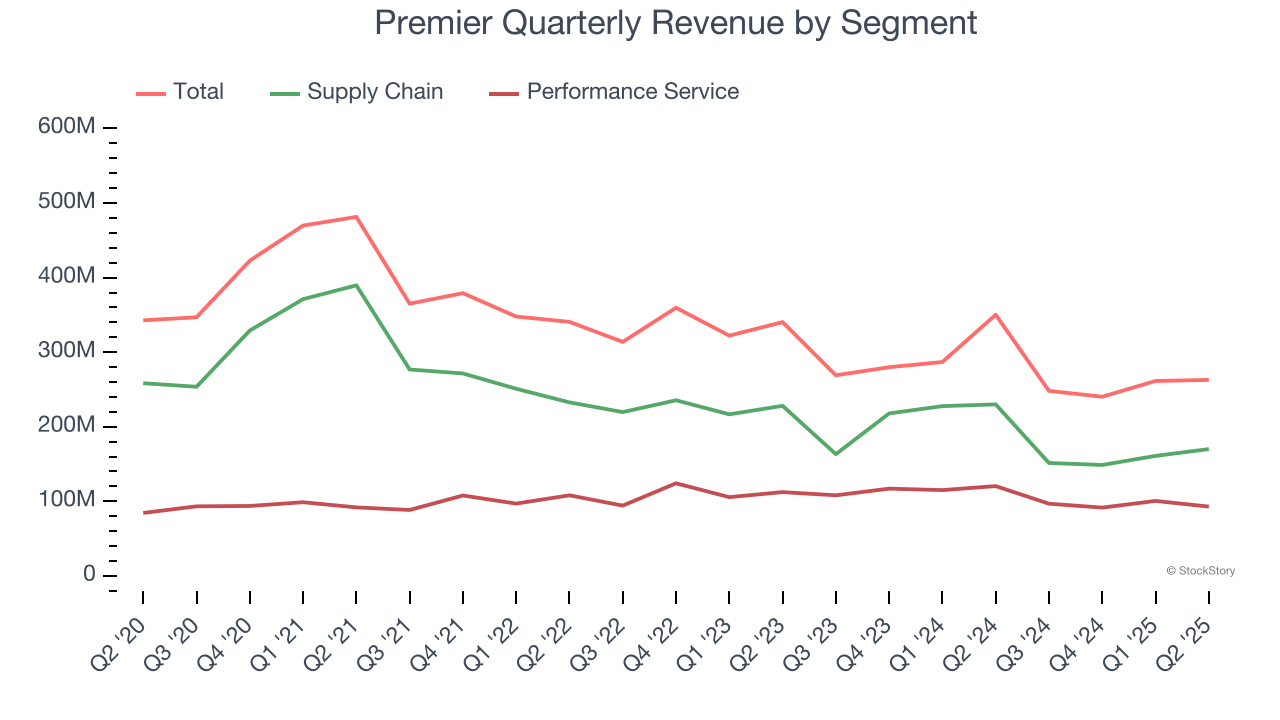

We can better understand the company’s revenue dynamics by analyzing its most important segments, Supply Chain and Performance Service, which are 64.7% and 35.3% of revenue. Over the last two years, Premier’s Supply Chain revenue averaged 15.2% year-on-year declines while its Performance Service revenue averaged 5.3% declines.

This quarter, Premier’s revenue fell by 25% year on year to $262.9 million but beat Wall Street’s estimates by 5%.

Looking ahead, sell-side analysts expect revenue to decline by 2.8% over the next 12 months. Although this projection is better than its two-year trend, it’s tough to feel optimistic about a company facing demand difficulties.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

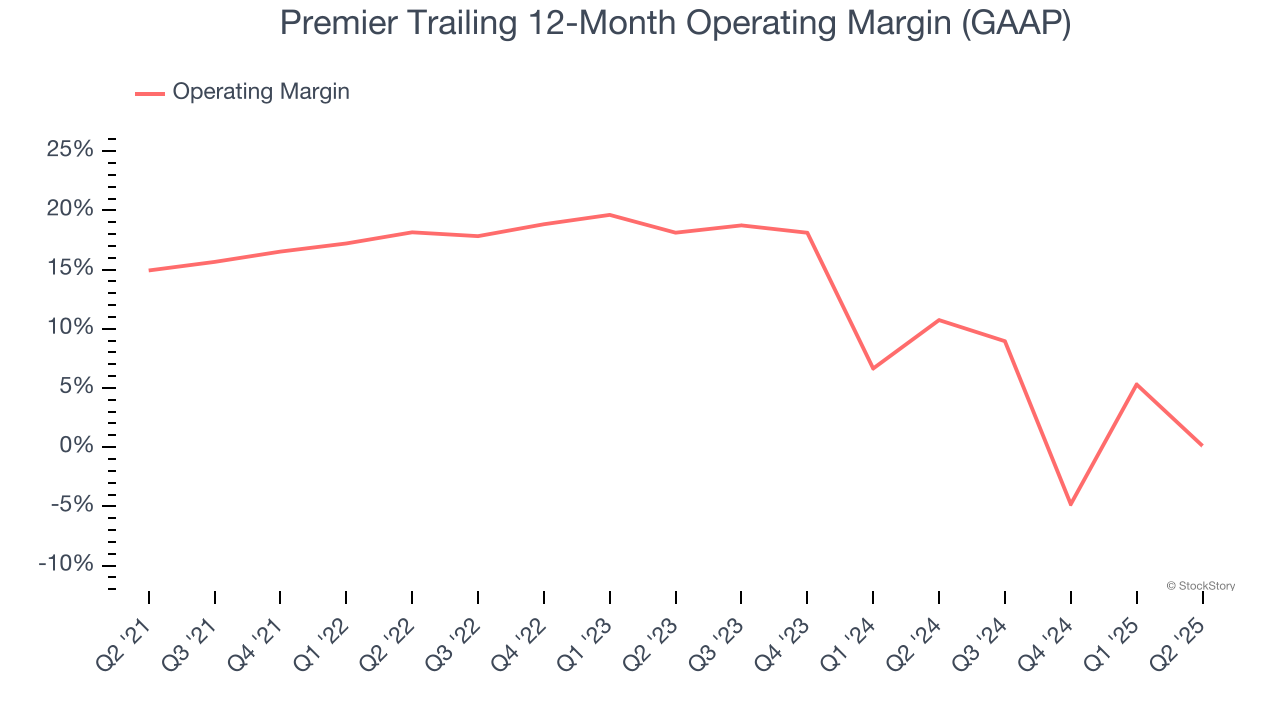

Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Premier has done a decent job managing its cost base over the last five years. The company has produced an average operating margin of 13.3%, higher than the broader healthcare sector.

Analyzing the trend in its profitability, Premier’s operating margin decreased by 14.8 percentage points over the last five years. This performance was caused by more recent speed bumps as the company’s margin fell by 18 percentage points on a two-year basis. We’re disappointed in these results because it shows its expenses were rising and it couldn’t pass those costs onto its customers.

In Q2, Premier generated an operating margin profit margin of 9.5%, down 14 percentage points year on year. This contraction shows it was less efficient because its expenses increased relative to its revenue.

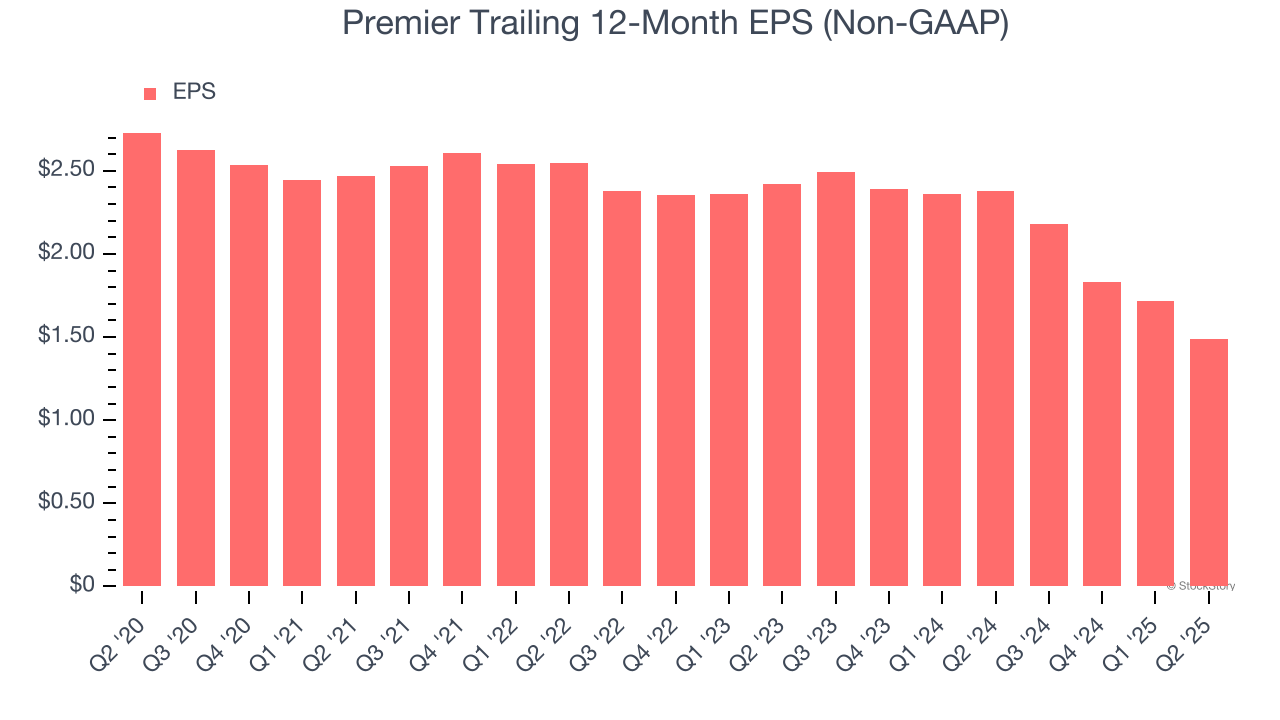

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Sadly for Premier, its EPS declined by 11.4% annually over the last five years, more than its revenue. This tells us the company struggled because its fixed cost base made it difficult to adjust to shrinking demand.

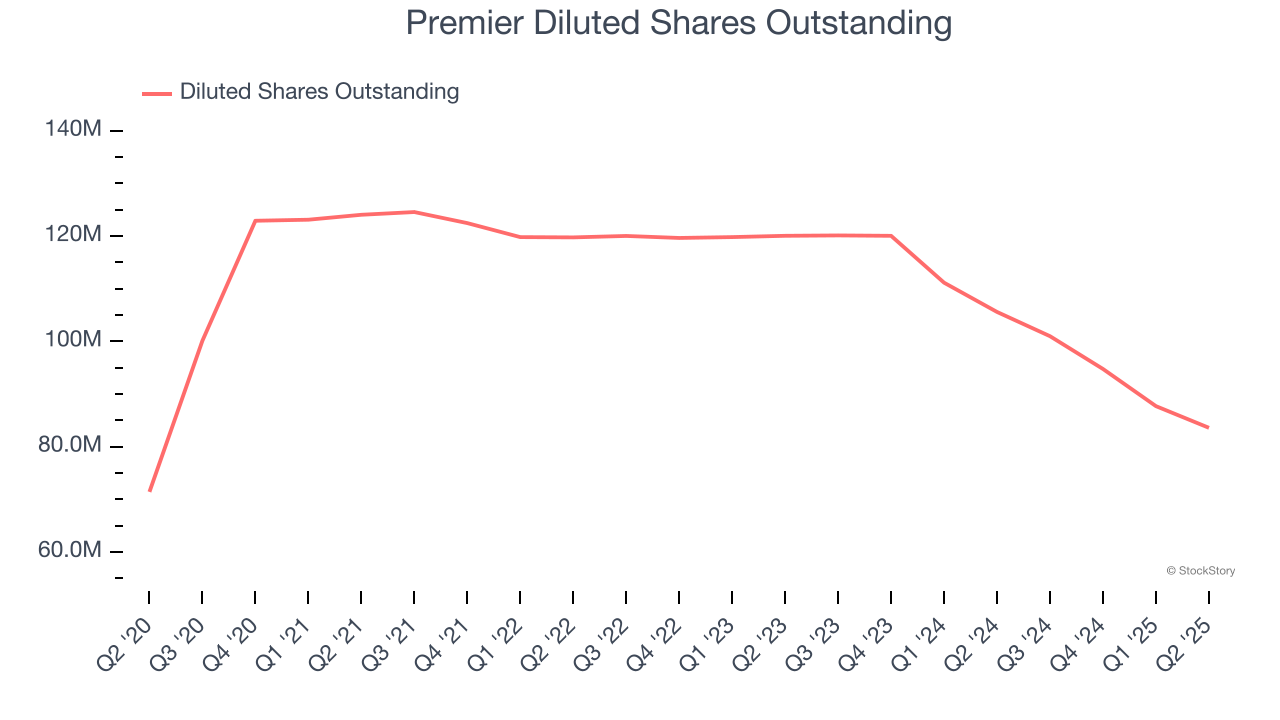

Diving into the nuances of Premier’s earnings can give us a better understanding of its performance. As we mentioned earlier, Premier’s operating margin declined by 14.8 percentage points over the last five years. Its share count also grew by 17%, meaning the company not only became less efficient with its operating expenses but also diluted its shareholders.

In Q2, Premier reported adjusted EPS of $0.46, down from $0.69 in the same quarter last year. Despite falling year on year, this print easily cleared analysts’ estimates. Over the next 12 months, Wall Street expects Premier’s full-year EPS of $1.49 to shrink by 7%.

Key Takeaways from Premier’s Q2 Results

It was good to see Premier beat analysts’ EPS expectations this quarter. We were also glad its revenue outperformed Wall Street’s estimates. On the other hand, its full-year EPS guidance slightly missed and its full-year revenue guidance fell slightly short of Wall Street’s estimates. Overall, this print was mixed, shares traded down 1% to $24.20 immediately following the results.

Is Premier an attractive investment opportunity right now? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.