As the Q2 earnings season wraps, let’s dig into this quarter’s best and worst performers in the maintenance and repair distributors industry, including Fastenal (NASDAQ: FAST) and its peers.

Supply chain and inventory management are themes that grew in focus after COVID wreaked havoc on the global movement of raw materials and components. Maintenance and repair distributors that boast reliable selection and quickly deliver products to customers can benefit from this theme. While e-commerce hasn’t disrupted industrial distribution as much as consumer retail, it is still a real threat, forcing investment in omnichannel capabilities to serve customers everywhere. Additionally, maintenance and repair distributors are at the whim of economic cycles that impact the capital spending and construction projects that can juice demand.

The 9 maintenance and repair distributors stocks we track reported a very strong Q2. As a group, revenues beat analysts’ consensus estimates by 2%.

Thankfully, share prices of the companies have been resilient as they are up 10% on average since the latest earnings results.

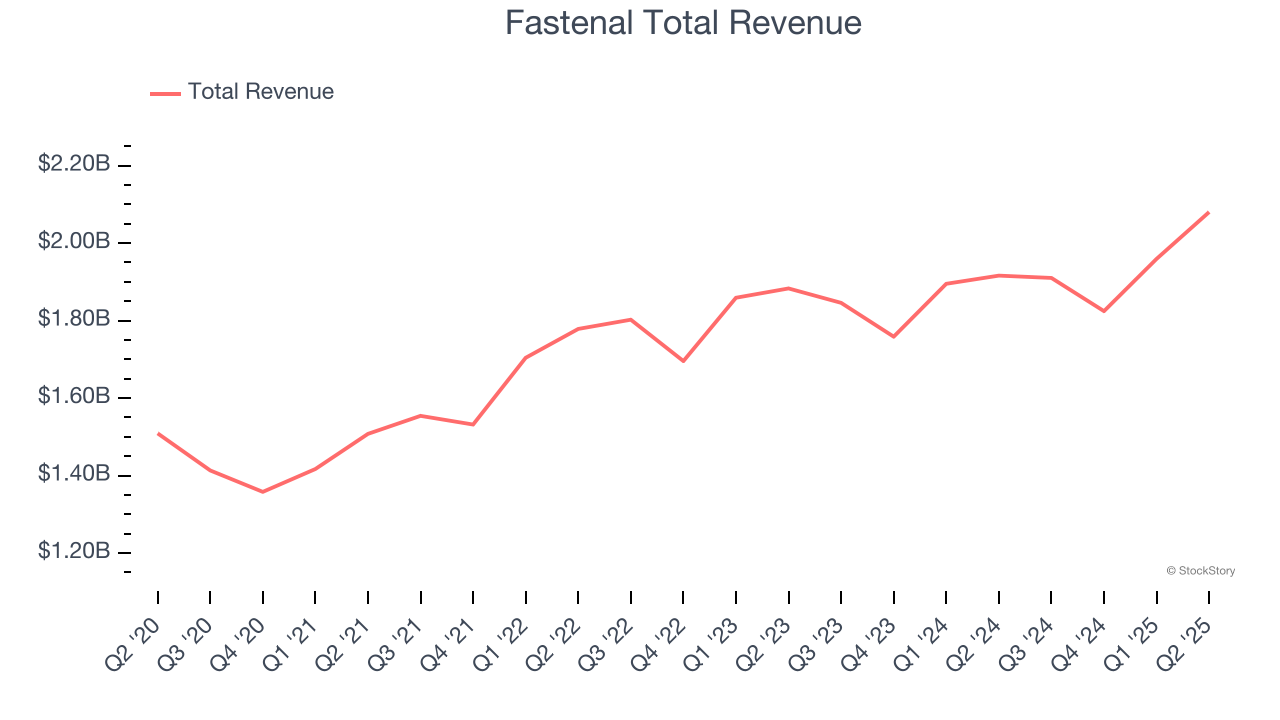

Fastenal (NASDAQ: FAST)

Founded in 1967, Fastenal (NASDAQ: FAST) provides industrial and construction supplies, including fasteners, tools, safety products, and many other product categories to businesses globally.

Fastenal reported revenues of $2.08 billion, up 8.6% year on year. This print exceeded analysts’ expectations by 0.5%. Overall, it was a very strong quarter for the company with a solid beat of analysts’ sales volume estimates and a decent beat of analysts’ adjusted operating income estimates.

Interestingly, the stock is up 10.9% since reporting and currently trades at $48.01.

Is now the time to buy Fastenal? Access our full analysis of the earnings results here, it’s free.

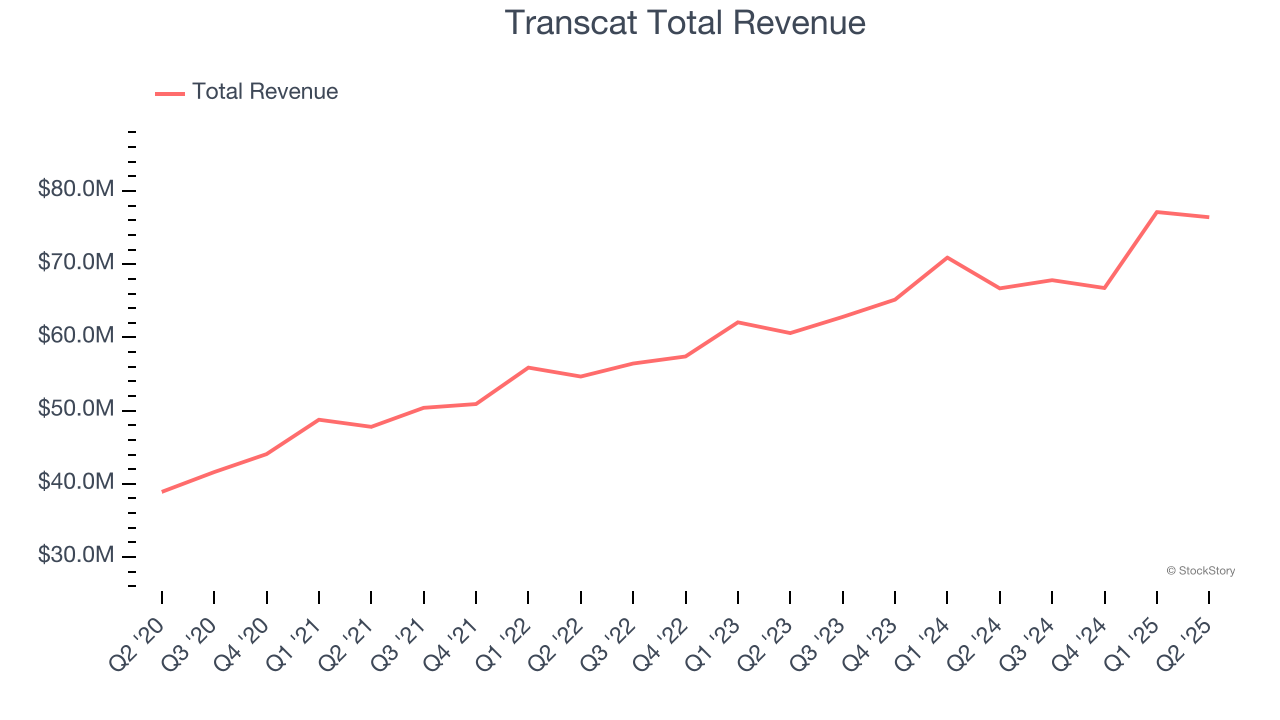

Best Q2: Transcat (NASDAQ: TRNS)

Serving the pharmaceutical, industrial manufacturing, energy, and chemical process industries, Transcat (NASDAQ: TRNS) provides measurement instruments and supplies.

Transcat reported revenues of $76.42 million, up 14.6% year on year, outperforming analysts’ expectations by 5.7%. The business had an incredible quarter with a beat of analysts’ EPS estimates and an impressive beat of analysts’ EBITDA estimates.

Transcat achieved the biggest analyst estimates beat among its peers. The market seems happy with the results as the stock is up 5.9% since reporting. It currently trades at $83.04.

Is now the time to buy Transcat? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: W.W. Grainger (NYSE: GWW)

Founded as a supplier of motors, W.W. Grainger (NYSE: GWW) provides maintenance, repair, and operating (MRO) supplies and services to businesses and institutions.

W.W. Grainger reported revenues of $4.55 billion, up 5.6% year on year, exceeding analysts’ expectations by 0.6%. Still, it was a slower quarter as it posted full-year EPS guidance slightly missing analysts’ expectations and a miss of analysts’ EPS estimates.

As expected, the stock is down 7.5% since the results and currently trades at $962.

Read our full analysis of W.W. Grainger’s results here.

VSE Corporation (NASDAQ: VSEC)

With roots dating back to 1959 and a strategic focus on extending the life of transportation assets, VSE Corporation (NASDAQ: VSEC) provides aftermarket parts distribution and maintenance, repair, and overhaul services for aircraft and vehicle fleets in commercial and government markets.

VSE Corporation reported revenues of $272.1 million, up 41.1% year on year. This print topped analysts’ expectations by 3.4%. It was an incredible quarter as it also logged a beat of analysts’ EPS estimates and an impressive beat of analysts’ EBITDA estimates.

VSE Corporation pulled off the fastest revenue growth among its peers. The stock is up 17.4% since reporting and currently trades at $165.94.

Read our full, actionable report on VSE Corporation here, it’s free.

Global Industrial (NYSE: GIC)

Formerly known as Systemax, Global Industrial (NYSE: GIC) distributes industrial and commercial products to businesses and institutions.

Global Industrial reported revenues of $358.9 million, up 3.2% year on year. This number beat analysts’ expectations by 2%. Overall, it was a stunning quarter as it also recorded a beat of analysts’ EPS estimates and a solid beat of analysts’ EBITDA estimates.

The stock is up 30.5% since reporting and currently trades at $35.39.

Read our full, actionable report on Global Industrial here, it’s free.

Market Update

Thanks to the Fed’s rate hikes in 2022 and 2023, inflation has been on a steady path downward, easing back toward that 2% sweet spot. Fortunately (miraculously to some), all this tightening didn’t send the economy tumbling into a recession, so here we are, cautiously celebrating a soft landing. The cherry on top? Recent rate cuts (half a point in September 2024, a quarter in November) have propped up markets, especially after Trump’s November win lit a fire under major indices and sent them to all-time highs. However, there’s still plenty to ponder — tariffs, corporate tax cuts, and what 2025 might hold for the economy.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Growth Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.