Metal packaging products manufacturer Crown Holdings (NYSE: CCK) met Wall Street’s revenue expectations in Q4 CY2024, with sales up 1.6% year on year to $2.90 billion. Its non-GAAP profit of $1.59 per share was 5.3% above analysts’ consensus estimates.

Is now the time to buy Crown Holdings? Find out by accessing our full research report, it’s free.

Crown Holdings (CCK) Q4 CY2024 Highlights:

- Revenue: $2.90 billion vs analyst estimates of $2.9 billion (1.6% year-on-year growth, in line)

- Adjusted EPS: $1.59 vs analyst estimates of $1.51 (5.3% beat)

- Adjusted EBITDA: $465 million vs analyst estimates of $475.1 million (16% margin, 2.1% miss)

- Adjusted EPS guidance for the upcoming financial year 2025 is $6.80 at the midpoint, in line with analyst estimates

- Operating Margin: 12.1%, up from 9.1% in the same quarter last year

- Free Cash Flow Margin: 5%, down from 15.5% in the same quarter last year

- Market Capitalization: $10.1 billion

"Crown delivered strong results in the fourth quarter, with segment income advancing 12% compared to the prior year," stated Timothy J. Donahue, Chairman, President and Chief Executive Officer.

Company Overview

Formerly Crown Cork & Seal, Crown Holdings (NYSE: CCK) produces packaging products for consumer marketing companies, including food, beverage, household, and industrial products.

Industrial Packaging

Industrial packaging companies have built competitive advantages from economies of scale that lead to advantaged purchasing and capital investments that are difficult and expensive to replicate. Recently, eco-friendly packaging and conservation are driving customers preferences and innovation. For example, plastic is not as desirable a material as it once was. Despite being integral to consumer goods ranging from beer to toothpaste to laundry detergent, these companies are still at the whim of the macro, especially consumer health and consumer willingness to spend.

Sales Growth

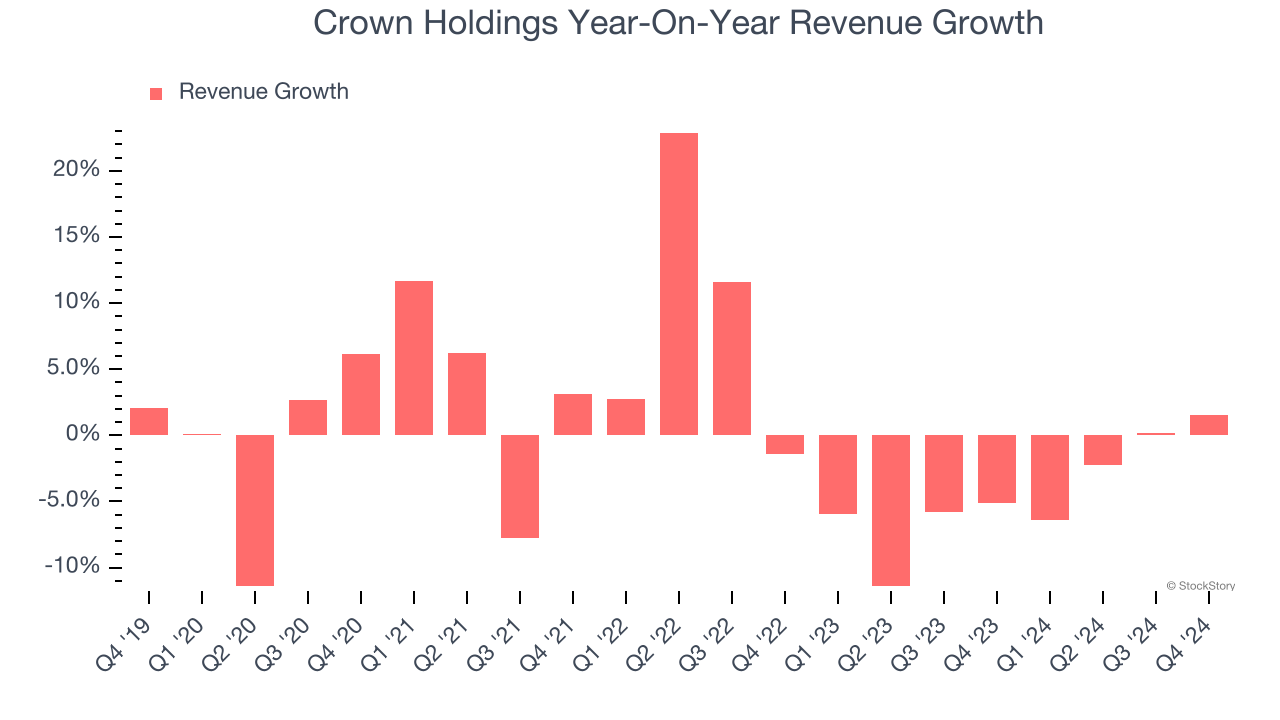

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Unfortunately, Crown Holdings struggled to consistently increase demand as its $11.8 billion of sales for the trailing 12 months was close to its revenue five years ago. This was below our standards and signals it’s a low quality business.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Crown Holdings’s recent history shows its demand has stayed suppressed as its revenue has declined by 4.5% annually over the last two years. Crown Holdings isn’t alone in its struggles as the Industrial Packaging industry experienced a cyclical downturn, with many similar businesses observing lower sales at this time.

This quarter, Crown Holdings grew its revenue by 1.6% year on year, and its $2.90 billion of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 2.5% over the next 12 months. While this projection suggests its newer products and services will catalyze better top-line performance, it is still below the sector average.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Operating Margin

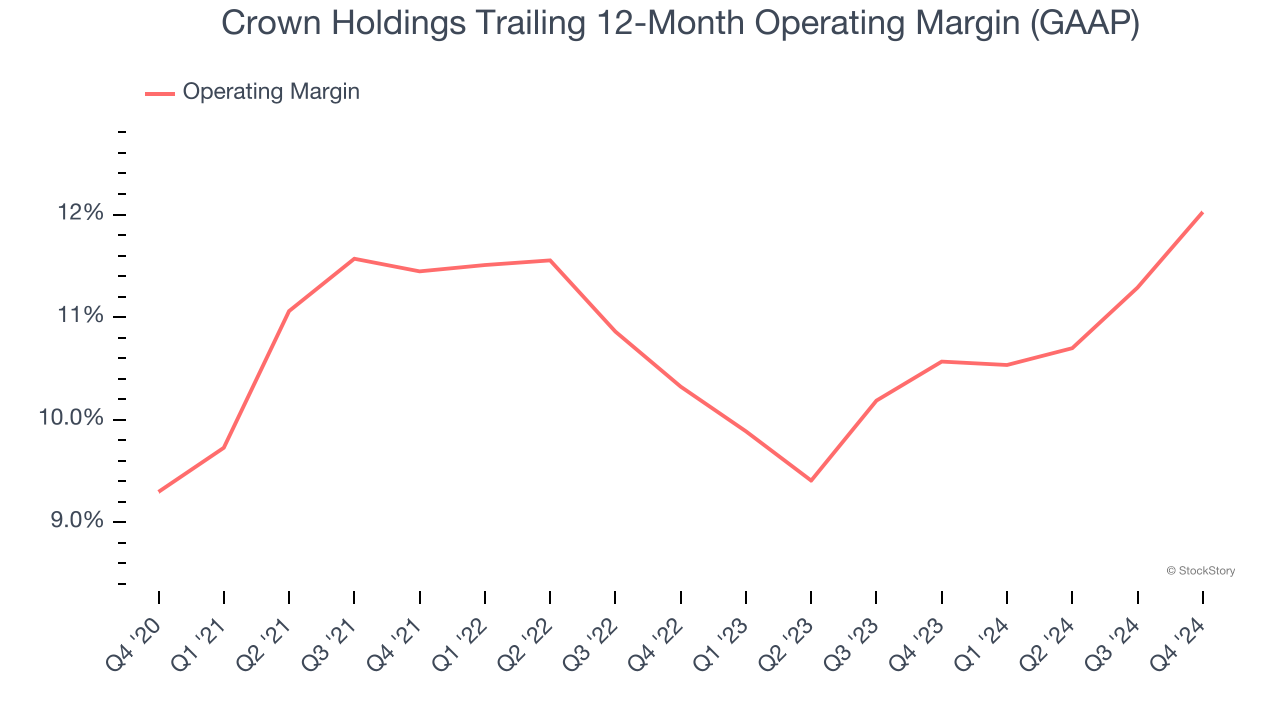

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after procuring and manufacturing its products, marketing and selling those products, and most importantly, keeping them relevant through research and development.

Crown Holdings has managed its cost base well over the last five years. It demonstrated solid profitability for an industrials business, producing an average operating margin of 10.7%. This result was particularly impressive because of its low gross margin, which is mostly a factor of what it sells and takes huge shifts to move meaningfully. Companies have more control over their operating margins, and it’s a show of well-managed operations if they’re high when gross margins are low.

Analyzing the trend in its profitability, Crown Holdings’s operating margin rose by 2.7 percentage points over the last five years. Its expansion was impressive, especially when considering the cycle turned in the wrong direction and most of its Industrial Packaging peers observed plummeting revenue and margins.

In Q4, Crown Holdings generated an operating profit margin of 12.1%, up 3 percentage points year on year. The increase was encouraging, and since its operating margin rose more than its gross margin, we can infer it was recently more efficient with expenses such as marketing, R&D, and administrative overhead.

Earnings Per Share

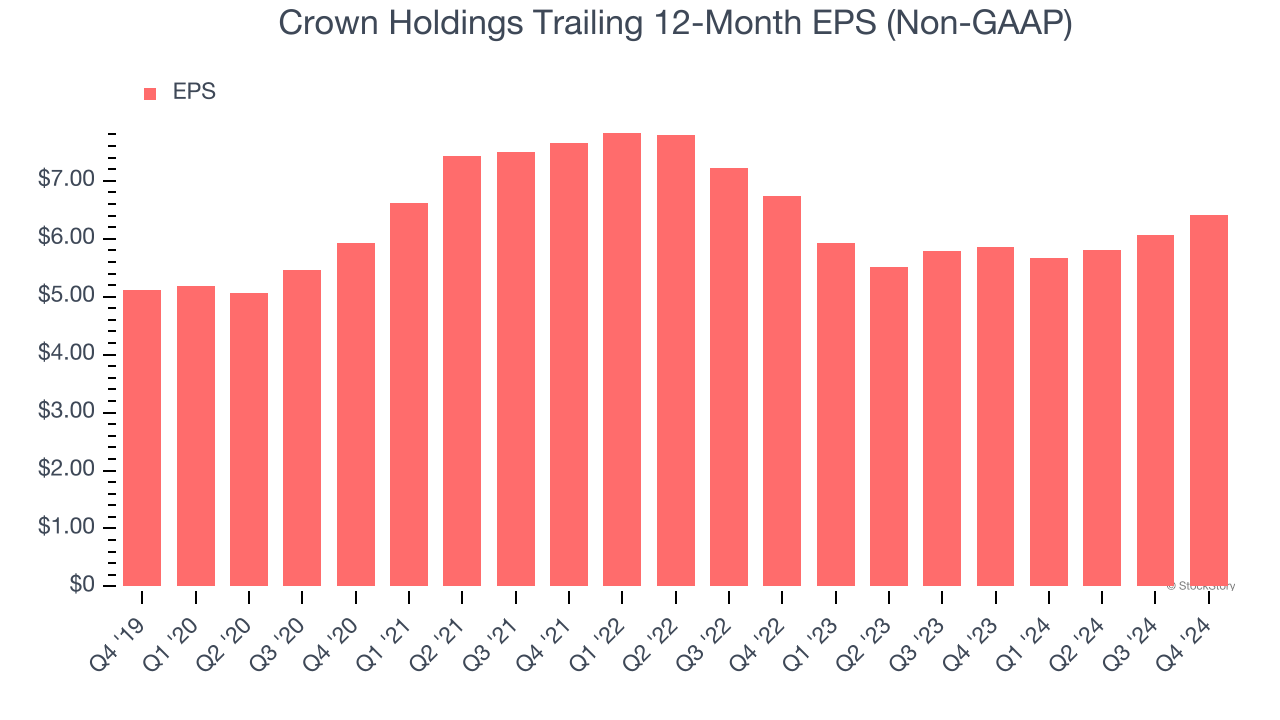

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Crown Holdings’s EPS grew at an unimpressive 4.7% compounded annual growth rate over the last five years. On the bright side, this performance was better than its flat revenue and tells us management responded to softer demand by adapting its cost structure.

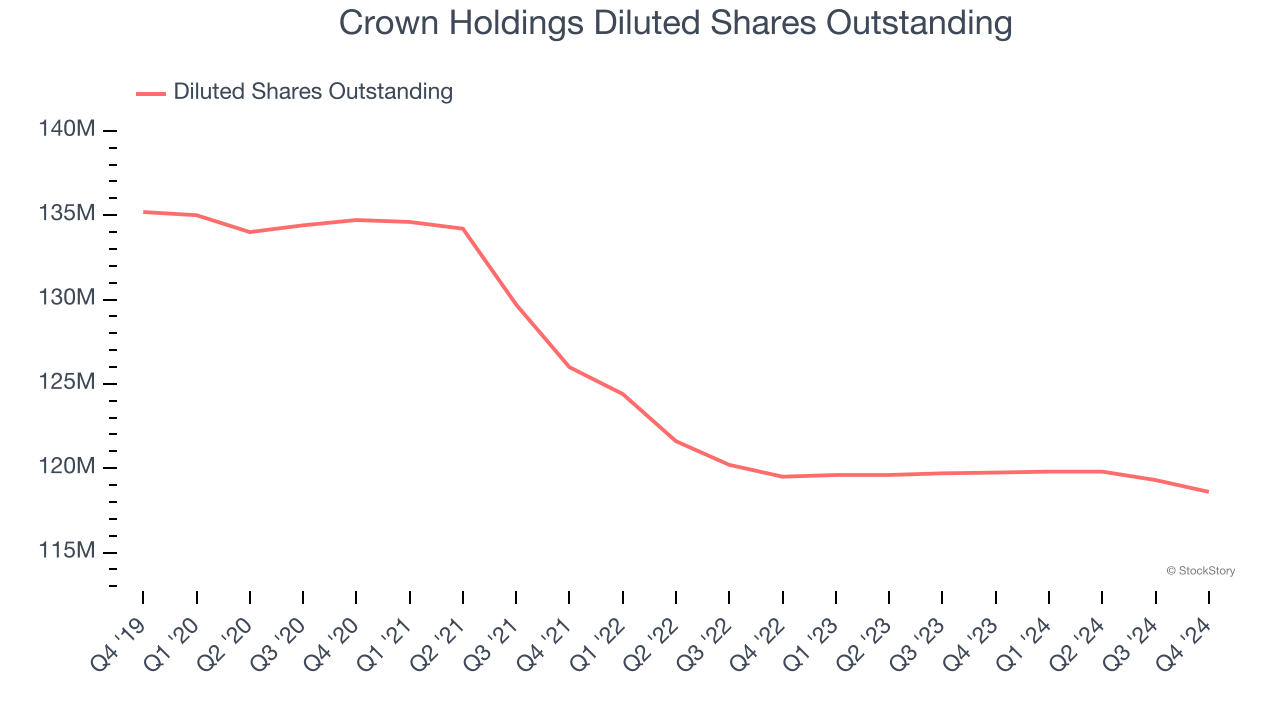

We can take a deeper look into Crown Holdings’s earnings to better understand the drivers of its performance. As we mentioned earlier, Crown Holdings’s operating margin expanded by 2.7 percentage points over the last five years. On top of that, its share count shrank by 12.3%. These are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Crown Holdings, its two-year annual EPS declines of 2.4% show it’s continued to underperform. These results were bad no matter how you slice the data.

In Q4, Crown Holdings reported EPS at $1.59, up from $1.24 in the same quarter last year. This print beat analysts’ estimates by 5.3%. Over the next 12 months, Wall Street expects Crown Holdings’s full-year EPS of $6.41 to grow 7%.

Key Takeaways from Crown Holdings’s Q4 Results

We were impressed by Crown Holdings’s optimistic EPS guidance for next quarter, which blew past analysts’ expectations. We were also happy its EPS outperformed Wall Street’s estimates. On the other hand, its EBITDA missed and its full-year EPS guidance was in line with Wall Street’s estimates. Overall, this was a softer quarter. The stock traded up 6.4% to $90.50 immediately following the results.

Big picture, is Crown Holdings a buy here and now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.