What a time it’s been for Roku. In the past six months alone, the company’s stock price has increased by a massive 45.6%, reaching $84.29 per share. This was partly due to its solid quarterly results, and the performance may have investors wondering how to approach the situation.

Is there a buying opportunity in Roku, or does it present a risk to your portfolio? Get the full breakdown from our expert analysts, it’s free.We’re glad investors have benefited from the price increase, but we're cautious about Roku. Here are three reasons why there are better opportunities than ROKU and a stock we'd rather own.

Why Is Roku Not Exciting?

Spun out from Netflix, Roku (NASDAQ: ROKU) makes hardware players that offer access to various online streaming TV services.

1. Customer Spending Decreases, Engagement Falling?

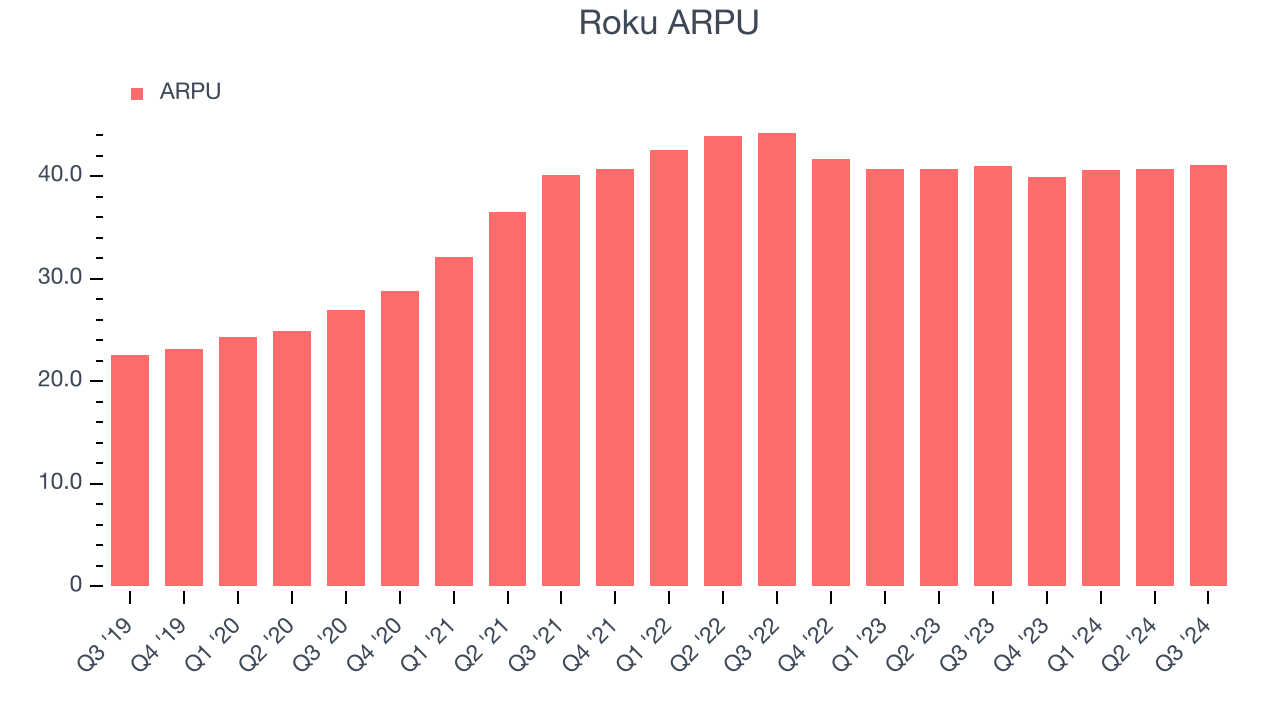

Average revenue per user (ARPU) is a critical metric to track for consumer subscription businesses like Roku because it measures how much the average user spends. ARPU is also a key indicator of how valuable its users are (and can be over time).

Roku’s ARPU fell over the last two years, averaging 2.6% annual declines. This isn’t great, but the increase in active accounts is more relevant for assessing long-term business potential. We’ll monitor the situation closely; if Roku tries boosting ARPU by taking a more aggressive approach to monetization, it’s unclear whether users can continue growing at the current pace.

2. EBITDA Margin Falling

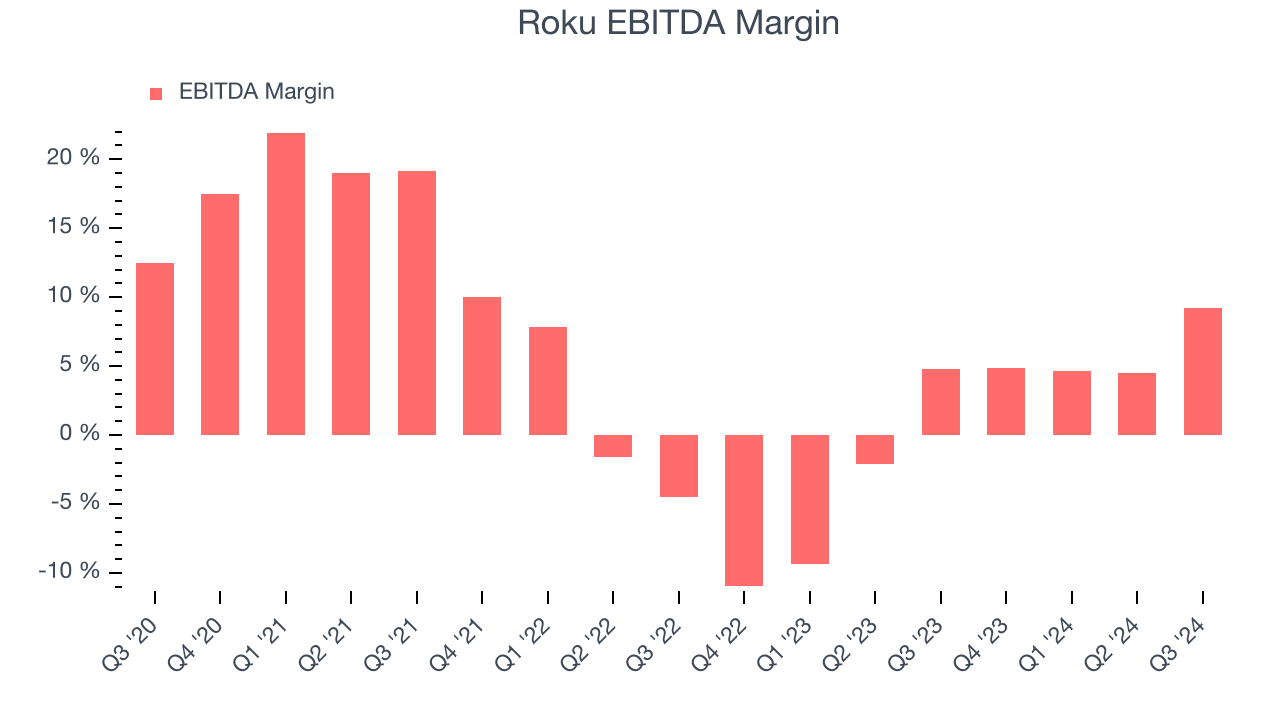

Investors frequently analyze operating income to understand a business’s core profitability. Similar to operating income, EBITDA is a common profitability metric for consumer internet companies because it removes various one-time or non-cash expenses, offering a more normalized view of profit potential.

Looking at the trend in its profitability, Roku’s EBITDA margin decreased by 13.4 percentage points over the last few years. Even though its historical margin is high, shareholders will want to see Roku become more profitable in the future. Its EBITDA margin for the trailing 12 months was 5.9%.

3. EPS Trending Down

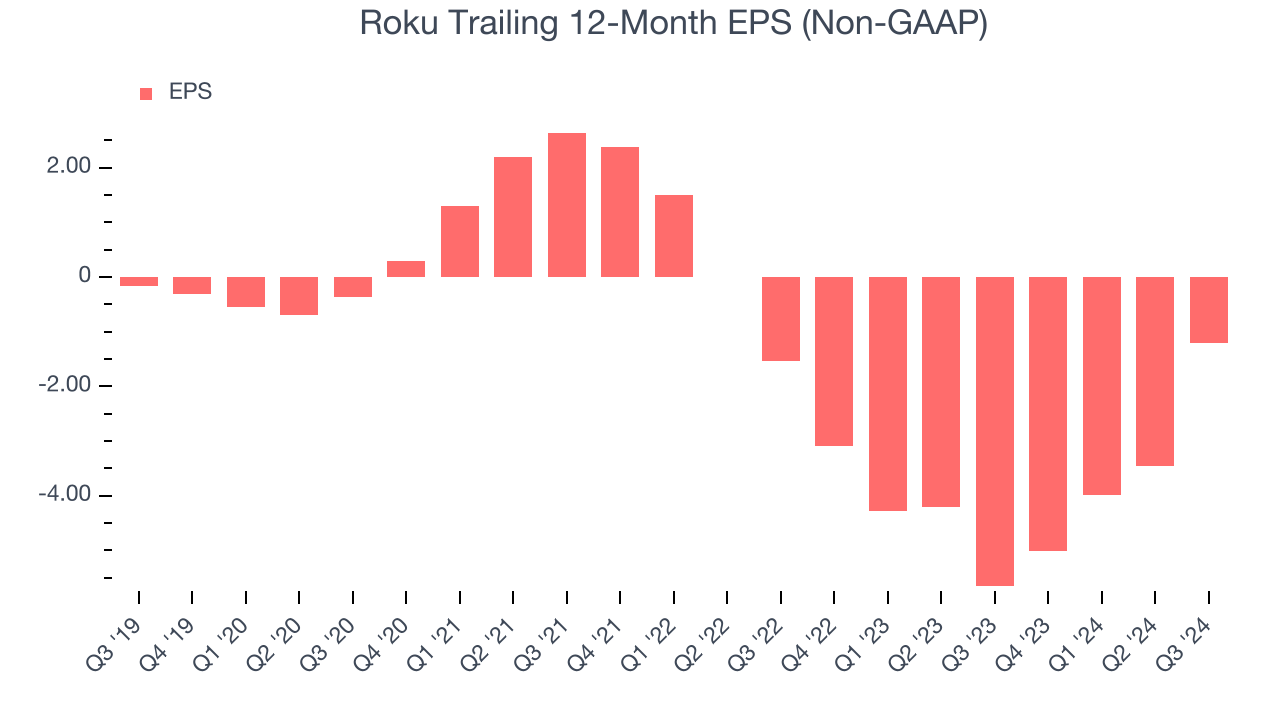

Analyzing the change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Sadly for Roku, its EPS declined by 34.9% annually over the last three years while its revenue grew by 15.2%. This tells us the company became less profitable on a per-share basis as it expanded.

Final Judgment

Roku’s business quality ultimately falls short of our standards. After the recent rally, the stock trades at 53.3× forward EV-to-EBITDA (or $84.29 per share). This valuation tells us it’s a bit of a market darling with a lot of good news priced in - we think there are better investment opportunities out there. We’d recommend looking at Chipotle, which surprisingly still has a long runway for growth.

Stocks We Like More Than Roku

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like United Rentals (+550% five-year return). Find your next big winner with StockStory today for free.