Extreme Networks Inc. (NASDAQ: EXTR) is a cloud-driven networking solutions provider that serves three seemingly “recession-proof” industries: government, education and healthcare. With nearly 40% of their revenues coming from government and education, this computer and technology sector company should fare relatively well even in uncertain macroeconomic conditions. However, shares are down nearly 38% for the year.

This can be attributed to inventory glut, which has been a common theme among peers like networker Ciena Co. (NYSE: CIEN), technology companies like Mobileye Global Inc. (NASDAQ: MBLY) and retailers like Under Armour Inc. (NYSE: UA).

What Does Extreme Networks Do?

[content-module:CompanyOverview|NASDAQ: EXTR]

Extreme Networks is a networking company that offers hardware and software-as-a-service (SaaS) solutions to enterprises, data centers and organizations. It sells the hardware and then uses a SaaS model to sell maintenance, services and software. It has integrated artificial intelligence (AI), security and analytics onto a single platform. This is what separates Extreme from competitors, helping drive 37% subscription ARR growth in its fiscal Q2 2024.

Inventory and Demand Improvement

B. Riley Securities upgraded Extreme Networks shares to a buy rating from hold. Analyst David King feels channel inventory and demand have been improving, notably with the normalization of channel inventory.

King cites the upbeat comments from one of Extreme Network’s largest customers IT solutions provider TD SYNNEX Co. (NYSE: SNX), which Extreme derives nearly 18% of its revenues from. TD SENNEX noted that the demand environment has stabilized, and the company expects further improvement in the second half of 2024. King also feels Extreme may have lowballed its estimates, leaving more runway for the upside. His price target is $14.

Broker Downgrades

Following its fiscal Q2 2024 earnings report, Rosenblatt and UBS downgraded Extreme Networks' shares to Neutral on Feb. 1, 2024. Rosenblatt cut its price target from $19 to $15, while UBS cut its target from $22 to $14.

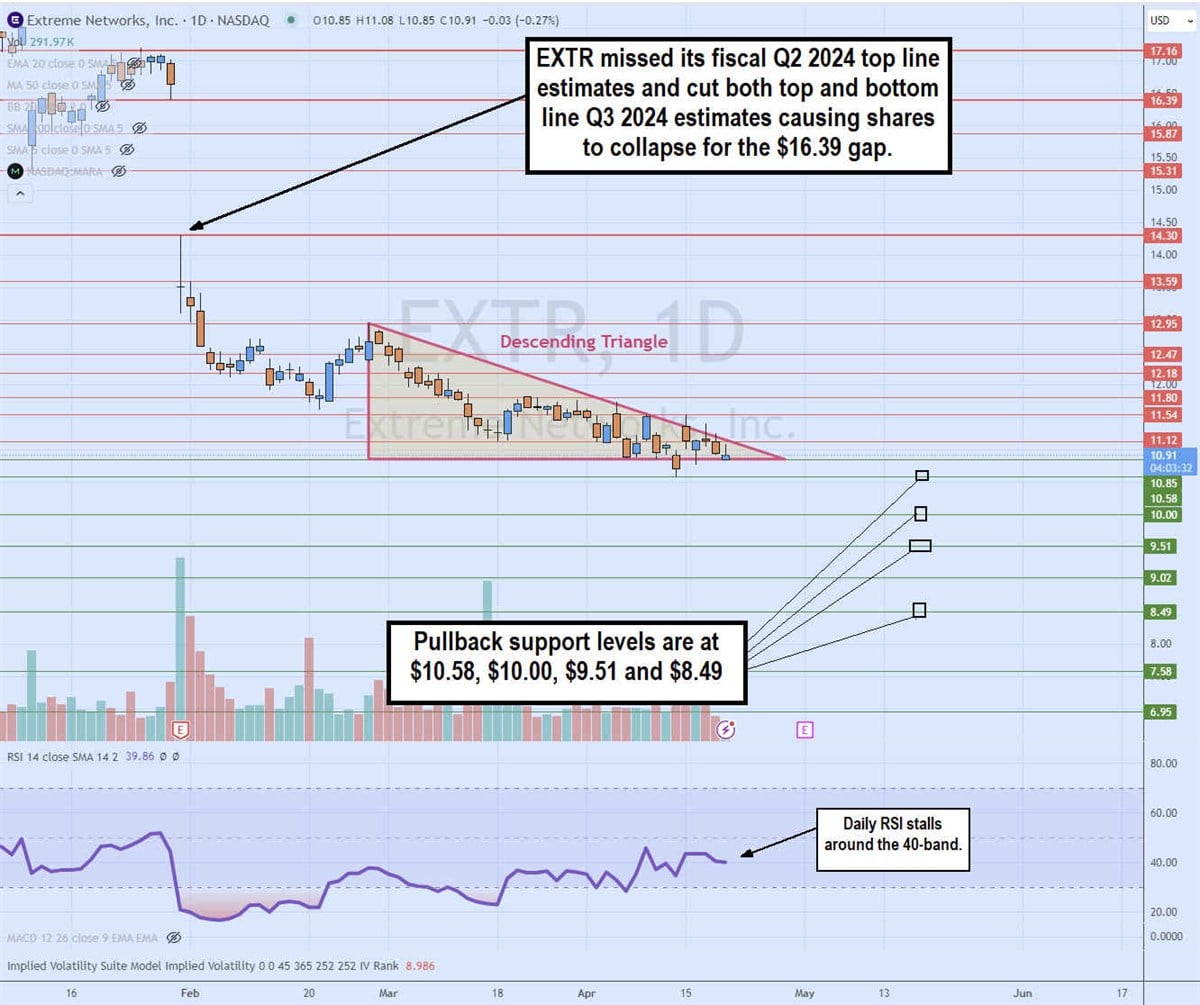

Daily Descending Triangle Pattern

The daily candlestick chart on EXTR illustrates a descending triangle pattern. The descending trendline formed at $12.95 on Feb. 28, 2024, falling to the flat-bottom lower trendline at $10.85. The daily relative strength index (RSI) has gone flat around the 40-band. EXTR is setting up for a breakdown through the lower flat-bottom trendline or a breakout through the upper descending trendline. Pullback support levels are at $10.58, $10.00, $9.51 and $8.49.

Missed the Runway

On Jan. 31, 2024, Extreme Networks reported EPS of 24 cents, beating consensus analyst estimates by a penny. Revenues fell 6.9% YoY to $296.4 million missing $303.2 million consensus estimates. The company noted that the product backlog has been normalized. Double-digit YoY bookings growth was prevalent in the EMEA and APAC regions. Cloud SaaS deferred subscription revenues rose 32% YoY to $246 million. ARR rose 37% YoY to $158 million. Non-GAAP gross margins rose 400 bps YoY to 62.5%.

Metrics to Watch

Extreme says 17% of its total product bookings came from new logos in the quarter. Logos refers to customers and refers to the company logos. The company acquired new customers that comprise 17% of the total quarterly bookings. The company grew its $1 million plus customers to 44.

Did Extreme Lowball Weaker Fiscal Q3 2024 Guidance?

Extreme provided soft guidance for fiscal Q3 2024 with EPS loss of 22 cents to 17 cents versus consensus analyst estimates for a profit of 28 cents. Revenue expectations were cut to $200 million to $210 million versus $321.36 million consensus estimates. Fiscal Q4 2024 revenues are expected to be between $265 million to $275 million versus $355.27 million.

CEO Insights

Extreme Networks CEO Ed Meyercord made upbeat remarks addressing the final stage of COVID-era supply chain constraints. Meyercord commented, "The networking industry, like much of IT, is exiting the final stage of the COVID-induced era of supply chain constraints, which is still impacting our business. As a result, our distributors and partners have lowered inventory purchases, which we expect to accelerate in the third quarter. We expect to emerge in the fourth quarter at a more normalized level of revenue and earnings. Our booking trends and funnel of new opportunities are a better reflection of customer demand. We're seeing stabilization across EMEA and growth in APAC.”

Extreme Networks analyst ratings and price targets are at MarketBeat.