Analysts opted for caution throughout 2022, rating shares of Tyson Foods, Inc. (NYSE: TSN) a hold. The MarketBeat consensus rating from analysts is lately creeping toward a bullish position. The stock is a potential value opportunity at around $60, by our estimates.

Tyson ranks as the 5th largest food and beverage business in the industry, according to FoodEngineering.com. After a hearty 2021, conditions in ‘22 sparked downward pressures on the stock price. It tumbled to a 52-week low where it stands starting the New Year from a +$100 high. This can be a buying opportunity.

Tyson Stock is Underperforming as the Food Sector Stabilizes

The average price target consensus is +20.5% to $75 during the next 12 months. The shares might hit a high of $97. Since last October, momentum has been increasing among food, consumer staples, and beverage stocks. For example, on average, the two largest food sector ETFs are up 5% yearly. Yet, Tyson shares are still down about 28% for the year.

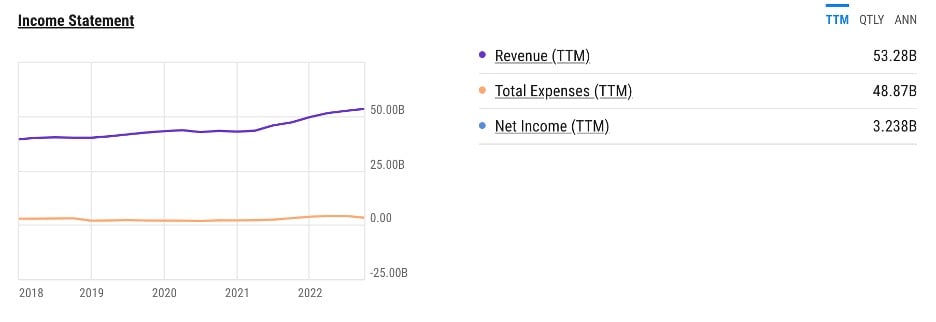

In response, management continues slicing SG&A costs and consolidating operations. They are spending more money on advertising. The company made 13 acquisitions, 3 in the last five years. Tyson is maximizing efforts in the popular food consumer trends, including organic meat and mimic meat. We expect revenue in 2023 to top $55 billion or +3%.

Courtesy Qube Investment Management https://qubeinvest.ca/project/stock-spotlight-tyson-foods/

The stock price appears to have found a foundation around $60. Short interest marked a low point at the end of November. It ticked up on December 15, but only to 1.7%. Volatility has gone out of the stock; its Beta is 0.69.

Inconsistent earnings and a plethora of other factors are keeping investors cautious. Adjusted EPS of $1.63 in Q4 ’22 was down 29% Y/Y though adjusted operating income was +3% Y/Y.

EPS Forecast is Good, as is the Dividend

The EPS forecast is steady and expected to increase in mid-2023. By June ’23, it might be up to $1.66 per share and to $1.77 in September.

The 88-year-old company’s (forward) dividend yield is 3.08%. A dividend raise in ’22 took it from $0.46 to $0.48.

Assets total $36.8 billion, and liabilities, as of September 30, are $17 billion. Debt ($8.3 billion)-to-equity ($19.8 billion) is a satisfactory 42%. The company cut the ratio from 96% over the last five years. In 2022, Tyson paid another $1 billion of debt and bought back 8.2 million shares.

Hedge funds move in and out of stock. 670 institutional buyers held shares in 2022, and 483 sold with more than $1 billion of in-flow. Corporate insiders sold shares worth $9.63 million in Q1 through Q4 ’22. They own a rather healthy 1.96% of the shares.

Food is an Essential Industry, but Tyson Foods Faces Challenges

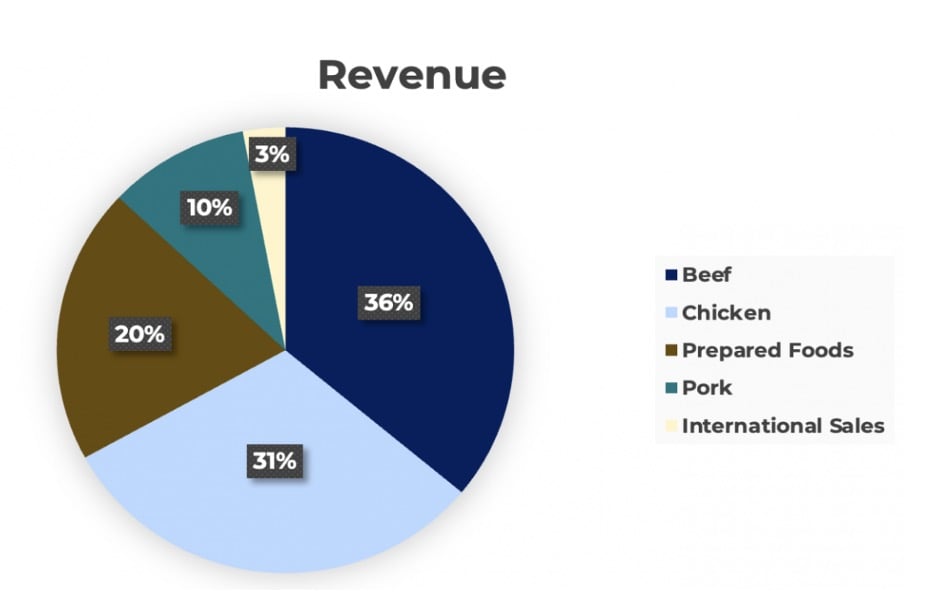

Tyson’s business is beef, pork, chicken, and prepared foods. Food is an essential industry. People need to eat every day. That is another reason Tyson makes for a good long-term investment. There are challenges: food insecurity, environmental issues, and inflation.

The food business is fraught but not ominous. Tyson is meeting the challenges that include supply and labor shortages. Bad weather, whether droughts, floods, storms or freezes, kills feed crops. Epidemics are reducing egg clutches, broods of chicken, herds of cattle and passels of hogs. Labor problems slowed or shut down production, hurt exports, and are driving up prices.

Exports of hogs and red meat (+50%) regained momentum in the second half of 2022. The impact will begin showing up in 2023 earnings reports. The next quarterly report is expected on February 6, 2023. The Y Charts graph demonstrates the rising revenue and near-to flat-line in expenditures.

Courtesy YCharts.com https://ycharts.com/companies/TSN

Good to the Last Bite

Tyson spent $283 million in 2022 on global advertising. It promotes Jimmy Dean, Hillshire Farm, Ball Park, and other brands. That is +$30 million more than Tyson spent in 2021. It positively affected revenue and earnings. The company settled labor troubles besetting it. Management closed plants. Corporate offices in Illinois and South Dakota are relocating to Arkansas in 2023.

We believe these changes will positively impact future earnings later in the year. With the moves management is making and demand for beef, chicken and pork holding steady, we expect Tyson shares will be, as Dr. Seuss wrote, “Off to great places! Today is your day.”