Carvana (CVNA) has pulled off one of the most striking turnarounds in recent memory. In fact, some now view it as a “former” meme stock, due to its financials rebounding to healthy levels, continuing growth, and unexpected profits.

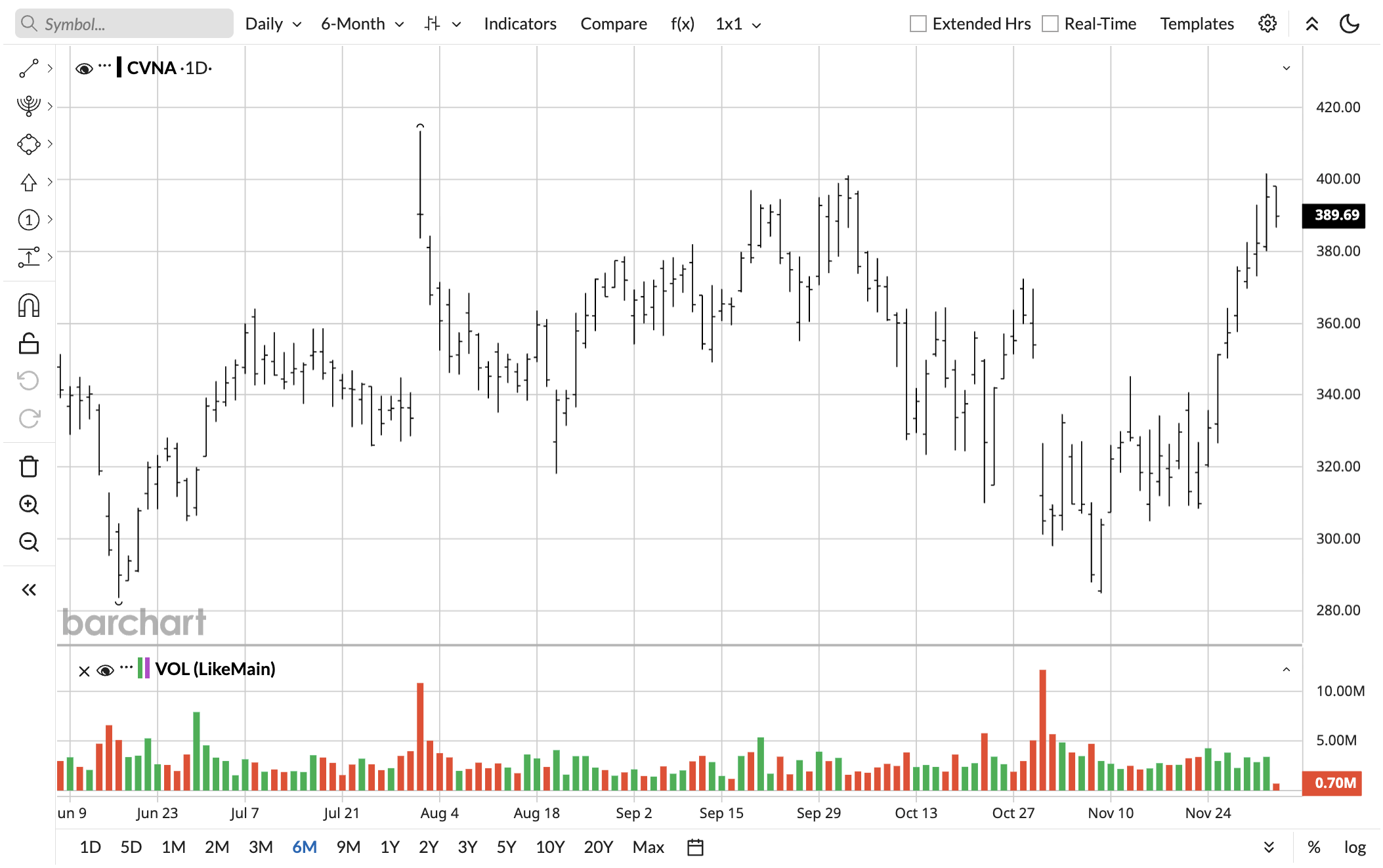

CVNA stock is up more than 11,000% since its trough in December 2022.

Analysts believe that CVNA stock can gain even more from here. UBS analyst Joseph Spak gave Carvana a $450 price target and a “Buy” rating this week. He predicted EBITDA for 2026 and 2027 to be 5% above analyst estimates. He also believes EBITDA could grow 25% annually through 2030.

Why UBS Is Bullish on CVNA Stock

The analyst has given more than just the EBITDA estimate as his rationale for his bullishness. He pointed out that Carvana makes double per car compared to its peers, and the unit economics are only getting better for the company.

UBS believes Carvana has a “differentiated, best-in-class online platform and customer experience” that positions it to win market share in the large, but fragmented, used-vehicle space.

It holds just 1.5% of the overall used-vehicle market today but has the potential to expand to 4% by 2030 and as high as 8% over the next decade.

UBS set its price target using a 29 times 2027 EV/EBITDA multiple. It places Carvana between auto retail and higher-growth internet companies.

What differentiates Carvana is that it is fully online with a no-haggling policy. That’s exactly what customers, especially younger ones, are looking for these days. It only means that Carvana will likely see increased popularity over time.

Carvana’s Solid Q3 Shows the Bull Case Is Playing Out Well

In Q3 2025, Carvana’s sold retail units increased 44% year-over-year to 155,941 for total revenue of $5.647 billion, up 55% year-over-year. These are both all-time high quarterly records.

Carvana was profitable for the quarter and had a net income margin of 4.7%. Adjusted EBITDA came in at $637 million.

Both the top and bottom lines came in well above analyst earnings estimates, with the top line beating estimates by 10.8%.

Carvana seeks to sell 3 million vehicles annually, with a 13.5% adjusted EBITDA margin over the next five to 10 years. This is achievable as more customers move online and wish to avoid haggling.

On top of that, Carvana’s $2.2 billion acquisition of Auto Dealers Exchange Services of America (ADESA) is already paying dividends. ADESA is a major wholesale vehicle auction company. Carvana has been integrating inspection and reconditioning centers with former ADESA sites, with 27 integrated centers set up as of Q3, up from nine a year ago.

The real estate is already there to support the annual retail production of 3 million units. It expects to have a fully built-out annual retail capacity of over 1.5 million units by the end of this year.

Should You Buy CVNA Stock Now?

Most analysts are also bullish, like UBS. The average price target is $427.71, with the highest price target at $500. Even the lowest price target of $330 points to tolerable downside risk from the current price.

The stock is still quite expensive, but I’d argue it’s worth the price. Interest rates are expected to come down again this December, which may boost auto-related companies significantly. Investors may also be underestimating how much growth online car dealerships may see in the coming years, as an increasing number of people do away with haggling at offline dealerships.

On the date of publication, Omor Ibne Ehsan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Salesforce Generates Strong Free Cash Flow - CRM Could Be 23% Too Cheap

- AMD Is Getting Ready to Launch Helios. Wall Street Thinks You Should Buy AMD Stock First.

- Meta Platforms Has Lost $73 Billion on Reality labs. Are Its Spending Cuts Enough for META Stock?

- UBS Analysts Think This Former Meme Stock Has Become a Disruptor -- And That It Can Gain 20% from Here